Global Macro Investor CEO, Raoul Pal, discussed the current economy this week and asked his 394,000 followers if people are using the wrong denominator when it comes to certain economic factors. One thing’s for certain, wages have not increased, no matter the common denominator people use to measure today’s salaries. Pal wholeheartedly believes that bitcoin is the only “life raft” he knows of that has “the optionality to change this [issue] over time.”

Macro Strategist Asks: ‘Do We Have the Wrong Denominator?’

Raoul Pal is a bitcoin bull and he’s said many times that the decentralized crypto asset is extremely “hard money.” This week on Twitter, Pal discussed a few denominators people leverage to measure things in economics. He asked his social media followers whether or not they thought we had the wrong denominator.

“Many of us believe that Fed money printing is creating an asset bubble. But when we switch the denominator to the Fed balance sheet equities look fairly priced,” Pal’s thread noted. When we look at SPX vs M2, the other measure people look at, equities are expensive but not wildly so…(it’s sort of just earning growth). Gold has done less well but ok (sort of [like] equities minus the earning growth),” Pal said.

As far as gold versus the M2, the entrepreneur says that the denominator has held its ground. M2 is the term used for a broad calculation of the easily convertible (liquid) money supply which includes checking deposits and cash.

SPX versus gold is 60% above its 100-year average Pal said and in his view, “gold is the best long-term denominator for assets.” Pal then said maybe a devaluation of the denominator is the real issue at hand.

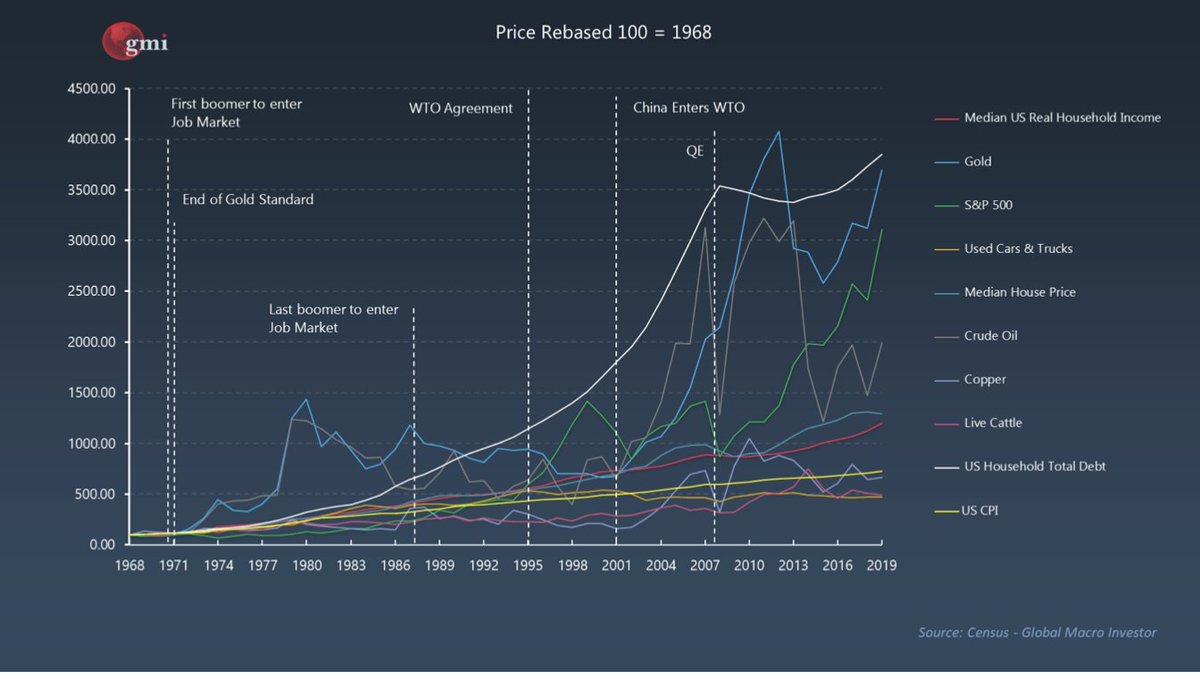

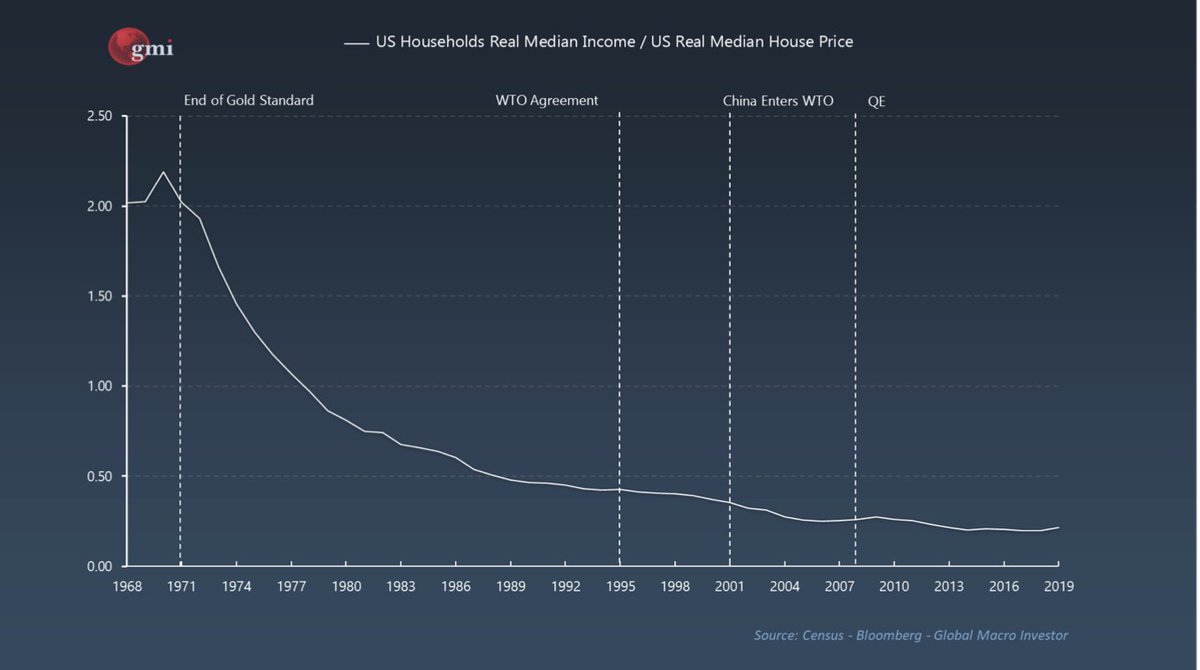

“We think of it as the [Federal Reserve] creating bubbles, but maybe it’s all fairly priced considering the change in [the] value of the denominator? Much like Venz equities rise when the currency devalues,” Pal stated. “However, the situation is much worse when you look at wages, which have barely moved in 50 years in real terms, underperforming all assets massive due to massive demographic bulges, globalisation, and technology,” he added.

In the United States, all wages have outperformed things like cars, trucks, and oil, but when the common denominator is gold it looks inferior.

“Another way is [to] look at how many hours [of] work it takes to buy an ounce of gold… Wages allow you no investment opportunity,” the Global Macro Investor executive emphasized. Purchasing equities is a joke as well said Pal because the median person gets to buy next to zero. People have lost 90% of their purchasing power when it comes to buying property he stressed.

Pal continued:

And that explains the rise in debt – Households added to maintain purchasing power… This is a theme BTC market participants picked up a long time ago. BTC has massively outperformed both M2 and the Fed balance sheet. You could interpret BTC as a bubble. You could suggest it hasn’t reached its full price discovery as many adopt it as their life raft as Metcalfe’s Law kicks in.

Bitcoin Offers a Chance to Change This Dynamic

Whatever the case may be Pal said, bitcoin (BTC) has dramatically offset “the wages/purchasing power/denominator issue.” He said that he thinks it is the only chance people have this day in age for someone to expand their economic horizons.

“It is literally the only chance the median person has to change this dynamic,” Pal asserted. “Especially young people who are in huge competition for jobs with boomers and their own massive generation and with technology and workers around the world, struggling to survive too.”

The Global Macro Investor executive thinks that the wage issue is forcing people to grow more upset and angry at the system. He noted that people feel poorer, they are poorer, they have more debt, and they need to obtain more debt, which is an “endless loop,” Pal stressed.

Pal concluded:

It’s a poverty trap of the middle classes. Bitcoin is the only life raft I know of that has the optionality to change this over time. It will get overly speculative, it will burst but it will rise again. I don’t see many alternatives as most can’t be successful entrepreneurs or market wizards. They need something to invest in. Something with high expected future returns. Or they could lower their cost base via a safety net.

Pal is extremely bullish about bitcoin’s future and for quite some time, the former Goldman Sachs executive said he’s been “irresponsibly long’ toward bitcoin. The macro strategist detailed at the time, that he was also short on the U.S. dollar.

“My conviction levels in bitcoin rise every day. I’m already irresponsibly long,” he noted. Following those statements, Pal said he decided to allocate 10% of his company’s balance sheet toward holding bitcoin and sold all his gold reserves for a portfolio of BTC and ETH.

What do you think about Raoul Pal’s conviction toward bitcoin? Let us know what you think in the comments section below.

Comments

Post a Comment