The price of bitcoin touched a new all-time high on Monday after the community discovered that Elon Musk’s firm Tesla added $1.5 billion worth of bitcoin to the company’s balance sheet. At press time, bitcoin is meandering over the $43k handle and has an overall market capitalization of around $814 billion today.

Crypto Markets Rise in Value

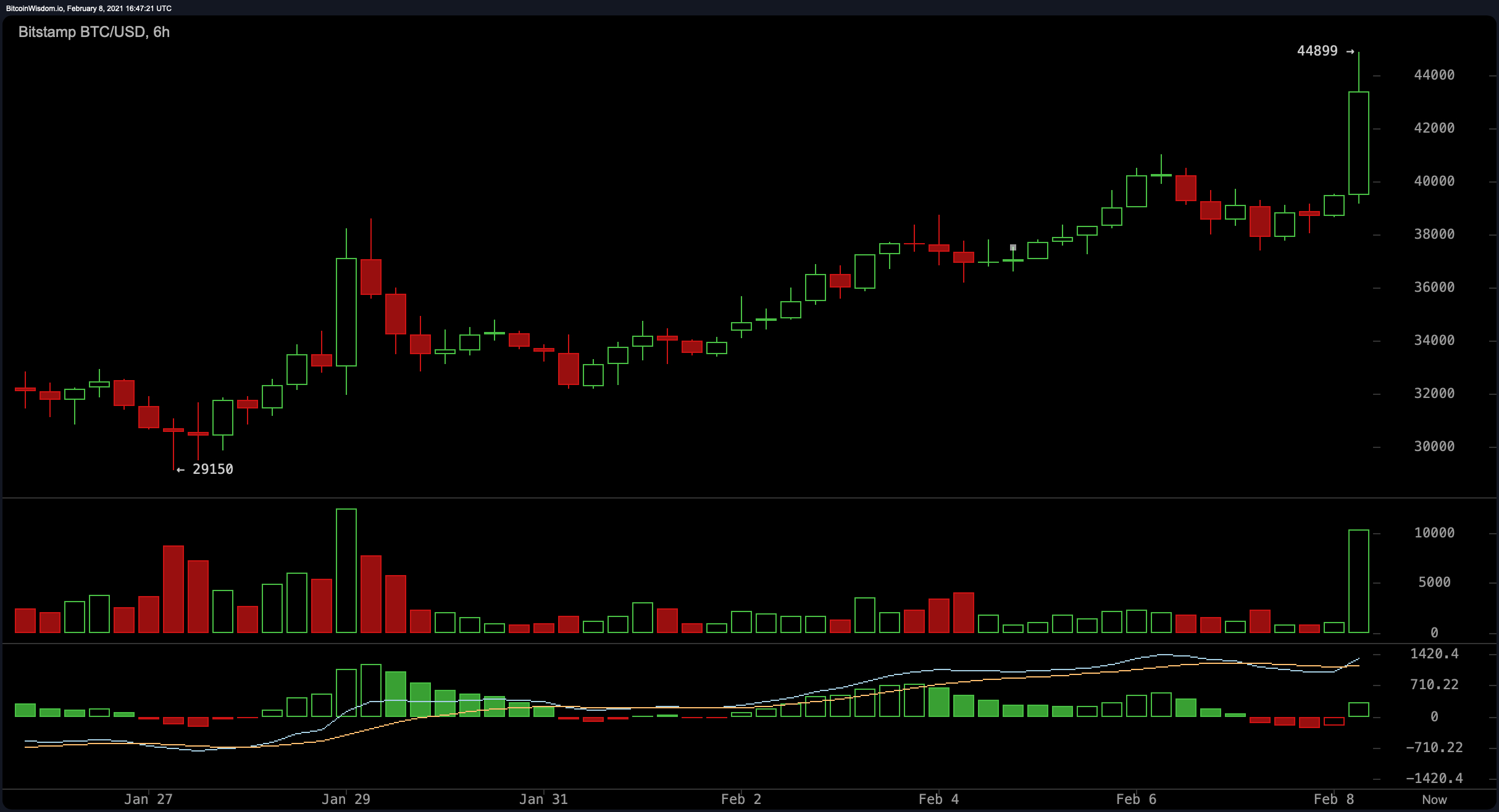

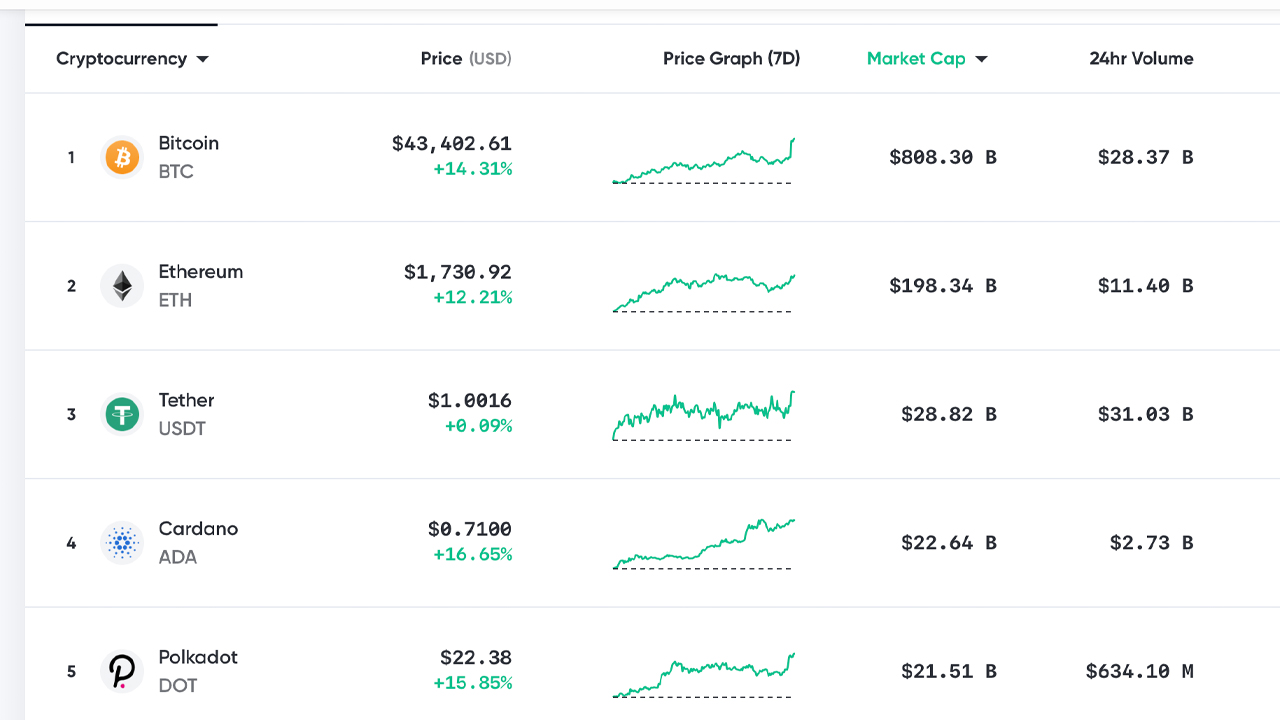

Bitcoin (BTC) shot up by thousands of dollars on Monday after the news about Tesla’s bitcoin made headlines and went viral on social media. The price per BTC hit a whopping $44,899 per unit and the price has retreated some since the top. Currently, bitcoin (BTC) is exchanging hands for $43,107 per unit with $27.9 billion in global trade volume. During the last seven days, BTC has risen over 30% and over 9% during the last month. 90-day stats show bitcoin is up 186% and 332% against the U.S. dollar for the last 12 months.

Ethereum (ETH) is up 13% today and trading for $1,713 per unit on Monday. In the fourth position stands cardano (ADA) which is up 12% and swapping for $0.68 per coin. The fifth-largest crypto asset, by market valuation, is polkadot (DOT) which has gained 16% on Monday and is trading for $22 per coin. Polkadot is followed by XRP ($0.45), LTC ($165), BNB ($73), DOGE ($0.081), and LINK ($25).

Ether Futures Begin to Trade on CME Group Global Markets

Ethereum (ETH) futures began trading today on CME Group’s derivatives markets. CME says that the launch further expands its derivatives offerings by adding the ETH token to the lineup.

Kicking off this Sunday evening: Ether futures start trading at 6:00 p.m. ET for a first trade date of Feb. 8. https://t.co/vc2hkZf9ql

— CME Group (@CMEGroup) February 7, 2021

“As institutional demand for transparent, exchange-listed crypto derivatives continues to increase, we are pleased to launch our new Ether futures contract,” Tim McCourt, CME Group Global Head of Equity Index and Alternative Investment Products said on Monday.

“The addition of Ether, along with our liquid Bitcoin futures and options, will create new opportunities for a broad array of clients, whether they are looking to hedge ether positions in the spot market or gain exposure to this cryptocurrency on a regulated derivatives marketplace,” McCourt added.

Tesla Adds Bitcoin to the Firm’s Balance Sheet, Analysts Believe More Businesses Will Follow Suit

A number of analysts said that they were also not surprised to hear that Elon Musk’s Tesla was getting into bitcoin after the announcement on Monday. David Mercer, CEO of LMAX Group said he expects even more big names to join the crypto space.

“We’re not surprised to see the headlines around Tesla’s move into bitcoin and expect 2021 will be a year that many other big names make the official crossover into the space,” the LMAX executive said on Monday. “Bitcoin’s resiliency in 2020 had already set the stage for this next major rotation, with bitcoin finally maturing into an asset capable of satisfying the needs of institutional participants.”

John Wu, President of Ava Labs also spoke about Tesla joining all the companies with bitcoin on corporate balance sheets. “Tesla’s purchase of $1.5B of bitcoin not only continues the momentum of public companies purchasing crypto, but could be a watershed moment that establishes some allocation of digital assets as a cornerstone of a healthy, diversified treasury,” Wu stressed.

“Regardless of industry, businesses should follow these early adopters establishing in-roads to the payment rails and financial infrastructure of the future. That starts with bitcoin, and will steadily expand to projects that are just outside the frame focused on the programmable, smart asset side of the ecosystem where enterprises can find more use cases beyond digital gold,” Wu added.

What do you think about the recent price movements within the crypto economy? Let us know what you think about this subject in the comments section below.

Comments

Post a Comment