Harvard Professor of Economics and former chief economist at the International Monetary Fund (IMF) Kenneth Rogoff says that central banks won’t allow bitcoin and other cryptocurrencies to become mainstream. “Eventually over the long course of history, the government first regulates and then it appropriates, and I think we can see that happening here,” he warned.

Harvard Professor’s Warning About Bitcoin

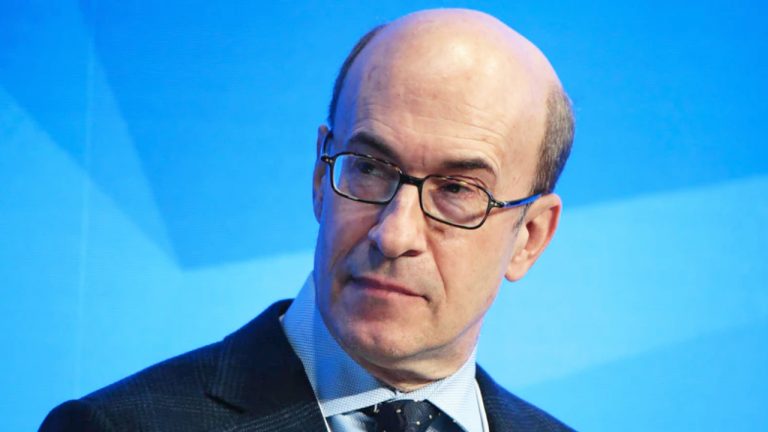

American economist Kenneth Rogoff shared his views on the future of bitcoin, its regulation, and the recent bull run in an interview with CNBC TV18 last week. Rogoff is the Thomas D. Cabot Professor of Public Policy and a professor of economics at Harvard University. He also served as chief economist at the International Monetary Fund (IMF) from 2001–2003.

“Zero interest rates can produce a lot of funny asset valuations. So that is certainly part of it,” he responded to a question about the rise in popularity of bitcoin and its recent bull run. “Clearly, there are a lot of wealthy people and well-known financiers, often very senior, who publically said they are investing in it [bitcoin] and that has given confidence.”

Nonetheless, the professor of economics cautioned: “But I have to say, regulation is in its early innings – if there is no final use case for bitcoins, [and] I don’t think it’s going to be, [then] ultimately this bubble will pop, but it could take a decade.”

Given the recent BTC price surge and the subsequent spike in its market capitalization, Rogoff was asked why central banks and governments have not passed strict regulations to control its trading or even banned it. “I think they are all over it,” the professor replied, pointing out that the Bank for International Settlements (BIS), the G7, and the G20 are all closely watching the cryptocurrency. “Every central bank is looking at this and trying to decide what to do,” he emphasized.

“The real issue is that for the moment it is not really used for a lot of meaningful transactions, except in war-torn states, where I think people use it to get money in and out. That’s certainly a good use,” Rogoff opined.

The economist proceeded to predict: “As it really starts to compete with ordinary, fiat currencies, government currencies, I think they’ll clamp down on it like a ton of bricks. They are not going to allow that to happen.” Comparing bitcoin to modern art, the economist elaborated:

Right now it is an asset class and I suppose in the way modern art is, but it doesn’t necessarily mean that it is in the mainstream. I think that is extremely misleading. Central bankers will never ever allow that.

A growing number of companies are investing in bitcoin, such as Elon Musk’s Tesla, which recently put $1.5 billion in the cryptocurrency, and Jack Dorsey’s Square, which invested $170 million more in BTC. Tesla will also be accepting bitcoin as a means of payment in the near future. Citing bitcoin’s rising adoption and a growing acceptance as a legitimate means of payment, such as what is happening in the U.S. city of Miami, Rogoff was asked if regulating bitcoin would become more difficult for governments.

“I don’t think regulating it is all that difficult,” he replied. “I think that there has been a hesitation to move too quickly because there has been a lot of innovation in the cryptocurrency space and governments want to allow that to proceed.”

In conclusion, professor Rogoff warned:

But make no mistake, the governments need to retain control over taxation, controlling crime, etc. They need to maintain control over the unit of account — the currency. Yes, private innovation can come out for a while, but eventually over the long course of history, the government first regulates and then it appropriates, and I think we can see that happening here.

What do you think about professor Rogoff’s bitcoin warning? Let us know in the comments section below.

Comments

Post a Comment