Pricing Gold, Food, and Altcoins With the BTC Denominator: How to Measure an Asset’s Worth in Bitcoin

On February 21, bitcoin touched a lifetime price high at $57,844 per unit after the crypto asset’s market valuation crossed the $1 trillion zone for the first time in history the day prior. Meanwhile, a number of digital assets have seen fiat values increase as coins like litecoin, ethereum, and others gather gains against the U.S. dollar. However, when bitcoin is the base denominator in terms of value, a lot of coins have a long way to go to catch up.

Measuring Alternative Crypto Assets With Bitcoin

The crypto asset bitcoin (BTC) has seen phenomenal gains and a lot of other digital currencies have seen price increases as well. For instance, ethereum (ETH) is the second-largest digital asset in terms of market capitalization, and ETH has touched the $2,040 price range.

Now ETH has seen pretty decent gains against the U.S. dollar, as it up a decent 76.32% during the last month, and 249.90% over the last three months. Traditionally people price everything in their local fiat currency like U.S. dollars or euros, but things look a whole lot different when other crypto assets are priced against or with BTC.

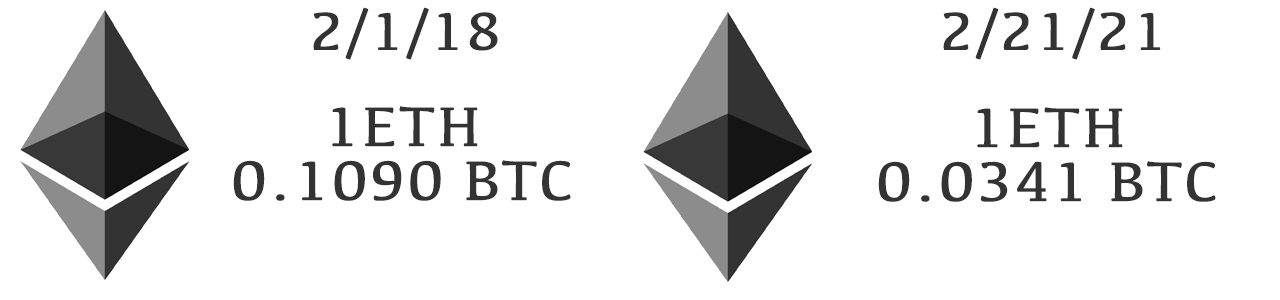

For instance, data from messari.io shows an ether priced in bitcoin is worth 0.0341 BTC and on Tradingview the price is a hair higher at 0.0343 BTC at the time of publication. Now even though ether has seen decent gains against the U.S. dollar in 2021, it was a lot higher in comparison to BTC back in 2018.

At that time in January 2018, a single ETH was around 0.1090 BTC. Bitcoin’s price at the time was around a third of what it is today, while ether’s value was closer to where it was back then albeit a touch higher. The same can be said for a myriad of other alternative assets in the crypto economy.

Litecoin (LTC) is a good example, as LTC is a cryptocurrency with a market valuation of around $15.5 billion and holds the eighth largest valued market cap. Against fiat, LTC has done well this year increasing over 66% during the last month against the U.S. dollar.

LTC has gained 157% against the dollar for the last three months, but has yet to capture the coin’s all-time high (ATH). Litecoin is still 38% away from the ATH three years ago, which was $369.32 per LTC. Back in February 2018, a single LTC was around 0.019533 BTC but today one LTC is swapping for 0.003966 BTC.

Pricing Everything in Bitcoin Gives a Different Perspective

People can price anything in BTC and in other common denominators or vice versa. For instance, a person can get a 2021 Lamborghini Huracan EVO today for 5.08 BTC, a brand new Honda Accord is only 0.44 BTC. You can get a pristine 3.0-carat diamond ring for a single BTC and 0.12 BTC buys the average American food for a whole year.

Back in the day when a single coin crossed parity with a single Federal Reserve note ($1), it was a milestone. Then years later, it passed the value of one troy ounce of fine silver ($27), and everyone noticed.

Years later the price surpassed the value of one troy ounce of fine gold and that definitely got some attention. On Saturday, BTC ripped into another ATH and crossed parity with one kilo of fine gold. The fact of the matter is, the common denominator can be perceived a whole lot differently when measuring things in BTC or against it.

What do you think about measuring assets and other cryptocurrencies in bitcoin? Let us know what you think about this subject in the comments section below.

Comments

Post a Comment