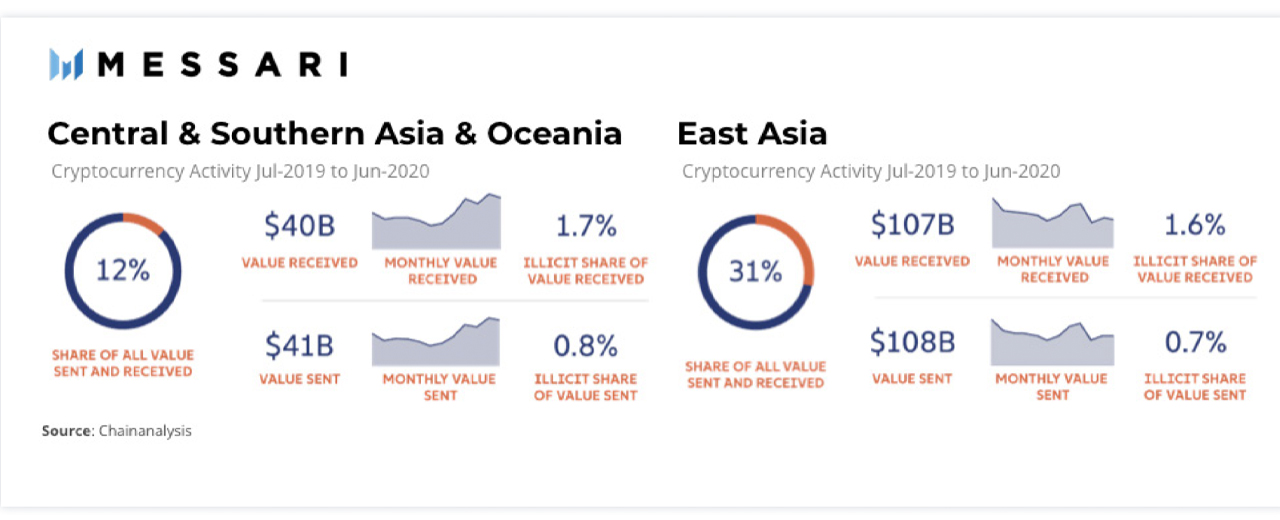

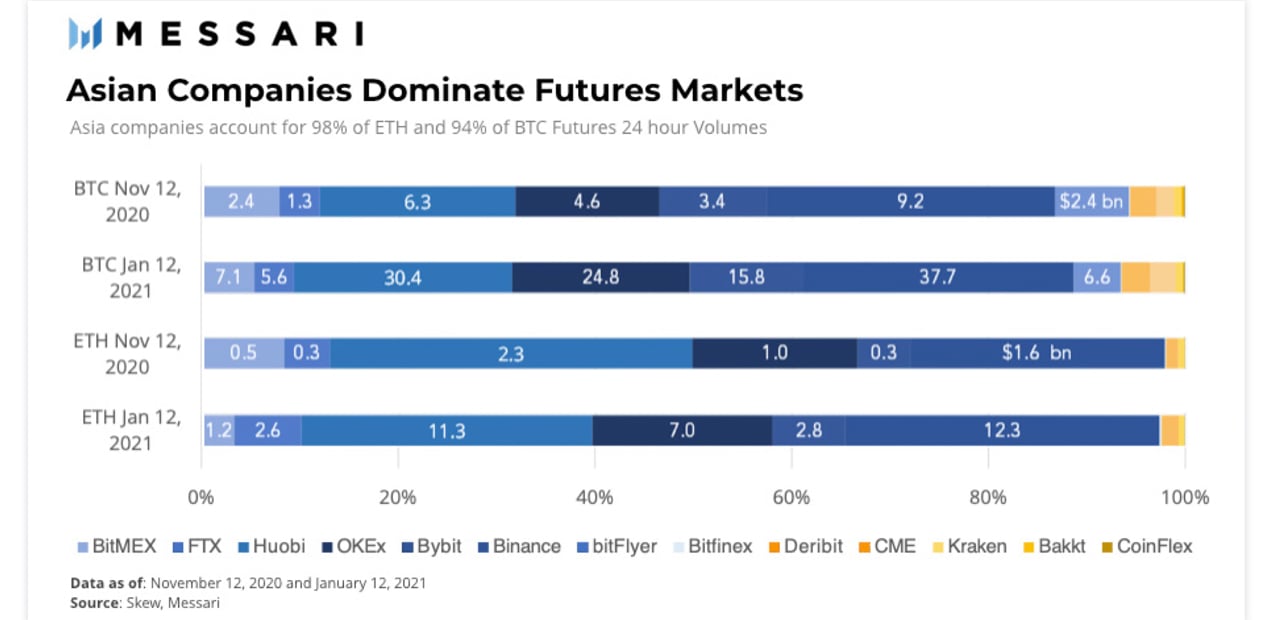

Recently, Messari Crypto Researcher, Mira Christanto published a report that looks into Asia’s cryptocurrency landscape in-depth, as 60% of the world’s population resides in the region. Christanto’s study shows that six out of the top ten largest cryptocurrency unicorns are located in Asia. Moreover, 98% of ethereum-based futures and 94% of bitcoin futures volumes stem from Asia.

Asia’s Financial Landscape Is Ripe for Disruption

When it comes to cryptocurrencies, Asia accounts for a huge number of crypto users, companies, miners, traders, and more. The cryptocurrency and blockchain researcher from messari.io, Mira Christanto, explains that Asia has a “history of dictators, currency depreciation, [and] capital controls – all ripe for disruption.” This has likely led to Asia being the most active cryptocurrency markets, according to Christanto’s recent findings.

Her recently published study called “Asia’s Crypto Landscape” covers the “key exchanges, funds, and market makers that define crypto in China, Japan, Korea, Hong Kong, Singapore, and Southeast Asia, with commentary on regulatory and investment trends.” Countries like China, Japan, Hong Kong, India, South Korea, Singapore, Philippines, Thailand, Indonesia, Vietnam, Malaysia, and more are covered in the 98-page study.

“Leading crypto countries, such as China, Japan, Korea, Hong Kong, and Singapore, have deep pools of liquidity, while other countries have a great potential to scale,” Christanto’s report says. “The nature of traditional finance has played a key role in the adoption of crypto: capital controls pushed investors towards cryptocurrencies in China and South Korea while low-yields pushed adoption in Japan,” she added.

“By the end of 2019, six of the top ten largest crypto firms in the world were located in Asia,” Christanto’s data further shows. “As of January 12, 2021, of the top 20 token projects with headquarters, 42% of the market capitalization is based in Asia. Asia has an outsize role in the crypto markets due to a variety of reasons.”

Christanto’s report continues:

Each country has its own nuances, but factors include high penetration of public market investing, high-technology pedigree, the prevalence of WiFi, deep penetration of e-payments, propensity for gambling, and high percentage of computer- science graduates. Furthermore, Asia’s development as a finance hub has helped contribute to fintech progress. Japan, Shanghai, and Hong Kong are among the top five largest stock markets in the world.

Asia’s Thriving Crypto Landscapes

A few key factoids from Christanto’s study show:

- Binance, Huobi, and Okex combined have about the same bitcoin holdings as Coinbase.

- Hong Kong is home to some of the largest crypto derivatives companies in the industry.

- Japan is a unique market with the largest retail foreign exchange industry, representing a third of total global foreign exchange (FX) and Contract for Differences (CFD) retail volume.

- South Korea has the highest penetration of crypto investors with a third of workers invested in crypto.

- Singapore is one of the more lax Asian markets for crypto-specific regulations, though strict on AML, KYC, fit-and-proper controllers, and FATF Travel Rule compliance.

- The Philippines has one of the largest overseas foreign workers populations in the world, ranking fourth in global remittance recipients.

Asia’s Crypto Landscape findings also indicate that a great number of countries in Asia have thriving landscapes and all for different reasons. For instance, Vietnam’s capital controls “means the crypto spot market operates somewhat in isolation,” Christanto says. Vietnam’s market is retail driven, the report notes and “when bitcoin prices are volatile, the Vietnam market lags by a couple of days.”

In Malaysia Luno is the top exchange in the country as the firm founded in 2013 in Cape Town, South Africa is dominant there alongside Singapore. Christanto and messari.io’s research also saw help from the independent blockchain infrastructure platform Blockdaemon.

Mira Christanto’s messari.io research report on the Asian crypto landscape can be read in its entirety here.

What do you think about Christanto’s 98-page study covering the Asian crypto landscape? Let us know what you think about this subject in the comments section below.

Comments

Post a Comment