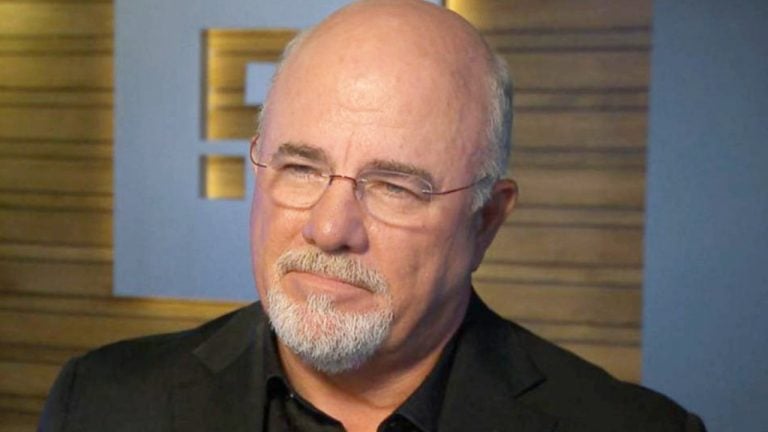

Personal finance expert Dave Ramsey has given some advice on what to do with bitcoin investments. While acknowledging that the cryptocurrency has had a “fabulous” run, Ramsey still prefers putting his money in more “proven” investments.

Dave Ramsey Still Not a Fan of Bitcoin

Famous radio show host and best-selling author Dave Ramsey gave some advice about bitcoin on The Dave Ramsey Show last week.

The self-proclaimed personal money management expert, Ramsey calls himself “America’s trusted voice on money.” He is the author of seven best-selling books: Financial Peace, More Than Enough, The Total Money Makeover, EntreLeadership, Dave Ramsey’s Complete Guide to Money, The Legacy Journey, and Smart Money Smart Kids. Altogether, they have sold more than 11 million copies.

Ray from Louisville, Kentucky, called into The Dave Ramsey Show to ask for advice about his bitcoin investment. “In late 2019, my income roughly tripled,” he began telling his story. “And in 2020, I got real aggressive with paying off debt and I was able to clear off a motorcycle debt, all credit cards, and the last two items are now a house and a car.” He also bought BTC last year. “I bought bitcoin, and it’s ballooned into this huge account now, worth roughly a hundred thousand dollars.”

He added: “One of the things I want to do with it is obviously pay off the car but it’s not quite enough to pay off the house, so I guess my question is do I wait with this volatile asset or do I sell it and move into something more traditional?” While noting that over the course of 2020, his BTC investment rose 649% and “the expectations are that it could go even higher,” he said bitcoin “is a volatile asset” that “swings now every day.” He admitted: “I’m just nervous about keeping this large amount of cash in this volatile asset but still having to worry about a house that I’d like to pay off in the meantime.”

Ramsey commented: “You’ve got Vegas problems, man. I mean you walked up to the slot machine, put a quarter in and it dumped a bunch of quarters out and now you have this temptation to think that’s a plan.” The financial guru added that this is “the problem with anything that is extremely volatile,” emphasizing that the investment is “unpredictable.”

The personal finance expert proceeded to tell Ray what he would do if he were in the same situation with a bitcoin account that had appreciated to $100K:

I would cash it all out tomorrow. I wouldn’t have been in it in the first place though.

Ray tried to justify his bitcoin investment decision. “I’m single. I felt I could afford to take the risk. I had a snowball plan for all the other items,” he said.

Ramsey responded: “You can do whatever you want to do. But, you’re asking me what I would do. I wouldn’t have been in it the first place and I wouldn’t stay in it. I would cash it out tomorrow, and I would put the money in some commonsense things.”

He also pointed out: “You’re sitting here explaining to me all the problems with the investment. You already know what you need to do. You just want somebody else to say it out loud.” The finance guru concluded:

Take your fabulous income and use that to build wealth with. That is a much more proven strategy to build wealth than playing volatile assets.

“Buying gold, or buying commodities, or buying bitcoin, or buying currencies, I mean, there’re a lot of volatile [assets]. You can do options. You can be selling short on the market. You can be day trading. There’re all kinds of things you can do and occasionally make money at it, and most of the time end up losing it … bitcoin is in that category. It’s a high-risk play,” Ramsey described.

He further explained, “Bitcoin’s had a fabulous run in the last year but that doesn’t mean it’s an investment you need to do.” Similarly, “Gold had a fabulous run for a while there but that doesn’t mean it’s an investment you need to do. These commodity plays and currency plays are just dangerous,” he opined.

In conclusion, while emphasizing to Ray, “You do what you want to do,” Ramsey noted:

I have zero money invested in that type of thing. I worked too hard for it and I really don’t have any desire to lose it. The government takes enough of it without me losing it.

Ramsey has long been a bitcoin skeptic. In December last year, he gave similar advice to another BTC investor who turned his $1,500 bitcoin investment into $120K. At the time, Ramsey doubted that the bitcoins could be cashed out, calling the cryptocurrency “funny money.”

What do you think about Dave Ramsey’s bitcoin advice? Let us know in the comments section below.

Comments

Post a Comment