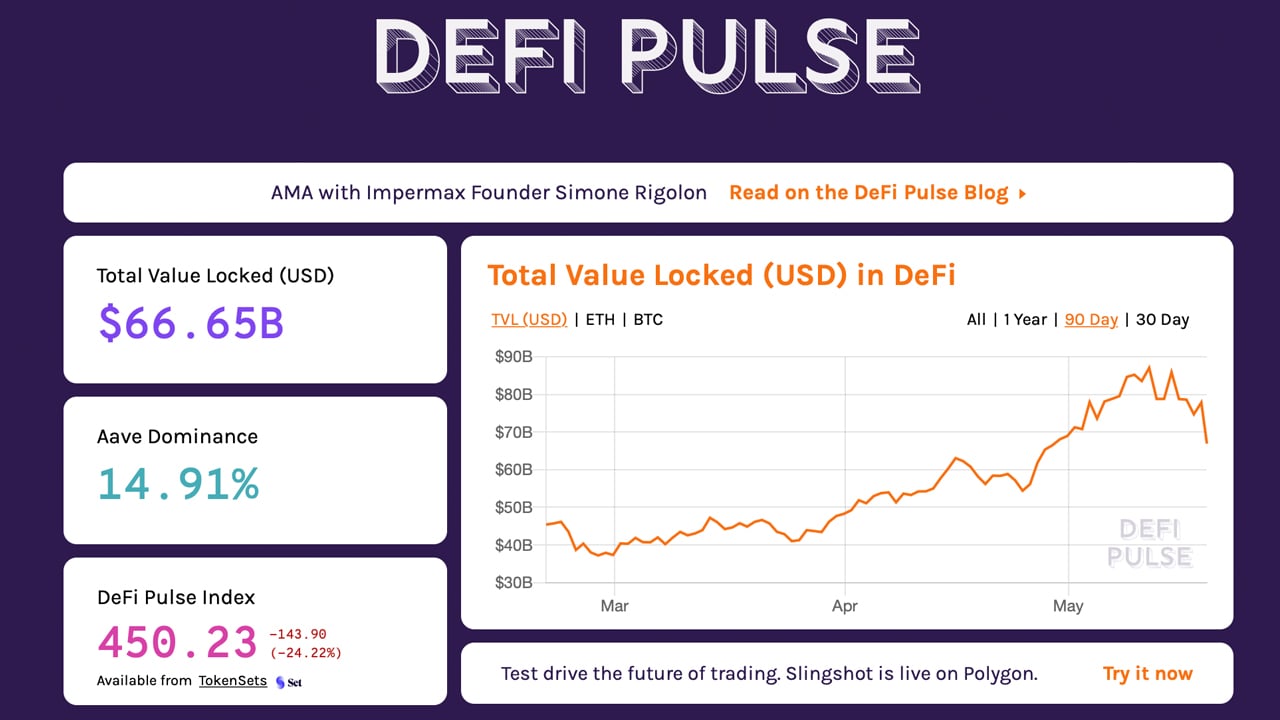

While crypto markets, in general, have been dropping significantly in value, the decentralized finance (defi) economy has shaved more than $21 billion during the last week. Statistics show that the total-value locked (TVL) in defi touched $87 billion on May 11, and since then the aggregate total has slid to $66 billion in value.

Weekly Stats Show Defi’s Total-Value Locked Metric Loses $21 Billion, TVL Drops 24%

Decentralized finance (defi) has been a very popular subject in 2021, as the economy’s TVL has accrued billions of dollars in just a few short months. Last week, the TVL in the defi economy according to defipulse.com data had shown the defi economy came awfully close to reaching $100 billion when it tapped $87 billion last Tuesday.

Eight days later, the TVL in defi has shed more than 24% dropping to $66.6 billion on May 19. For example, crypto-assets leveraged in the defi economy like ethereum (ETH), binance coin (BNB), and the slew of ERC20 assets in existence, have all lost considerable value during the last three days. ETH has shaved 30% off its price, while BNB lost 26% over the course of the last day.

Native coins for defi projects like Uniswap’s UNI have lost value as well, as UNI has seen a 27% drop in value during the last 24 hours. The only defi tokens that have not lost value are fiat-pegged stablecoins such as DAI, USDC, and USDT.

$41 Billion in Dex-based Swaps- Decentralized Exchange Volumes Still High

At the time of publication, statistics show that the Aave project commands the most dominance on defipulse.com’s aggregate TVL with 14.91%. Daily percentages show Maker is down 20%, Aave 1.65%, Compound 9.9%, and Polygon 1.7%.

Decentralized exchange (dex) percentage drops show Curve is down 7.4%, Uniswap 6.7%, and Sushiswap is down 6.2%. However, trade volume stats from Dune Analytics shows dex volumes have hit $41 billion during the past seven days. Dex volumes have been sky high all year long, as popular dex platforms have been moving in on centralized exchange competitors.

Data further indicates that Uniswap commands the top trade volume out of 16 dex platforms listed on Dune Analytics dex stats page today. The list includes Uniswap, Sushiswap, 0x Native, Curve, Bancor, Balancer, Tokenlon, Dodo, Dydx, Synthetix, Kyber, Airswap, Mooniswap, Linkswap, Ddex, and 1inch respectively. During the past 24 hours, Uniswap has seen $5.5 billion in global trade volume, while Sushiswap it’s forked competitor, captured $2.7 billion.

What do you think about the defi economy losing over $20 billion during the last week? Let us know what you think about this subject in the comments section below.

Comments

Post a Comment