Like Bitcoin, DeFi’s ambition to build a fully decentralized global network is the fundamental source of its revolutionary characteristics – that of being trustless and enabling disintermediation. It is these two characteristics that build the core value of DeFi and determine its long-term market growth. It’s easy to see why this is so:

- On the one hand, the core model of any DeFi project must be zero-centric in order to carry unlimited trust, exhibiting the value of a decentralized network beyond the market value of one single product or a brand.

- On the other hand, a decentralized network must also be disintermediated, in order to compete with centralized products and retain its most critical competencies.

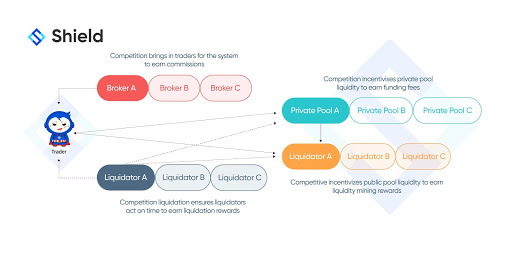

A non-cooperative network is a naturally robust decentralized network model. Shield is building a decentralized non-cooperative game theory based, derivatives trading network consisting of traders, dual liquidity pools, liquidators and brokers.

Shield Decentralized Network Based on Non-cooperative Game Theory

Non-cooperative game theory was first proposed by John Forbes Nash in 1950, describing a multiplayer game system that is not limited to two people (i.e., a zero-sum game) and that is stable after achieving a “Nash equilibrium”. Before the birth of blockchain, most governance systems of human society, including banks, exchanges, internet majors, and social institutions were based on zero-sum games. Zero-sum game systems pinned their hopes on leaving organizational functions, or providing order to combat decay, to a few centralized parties.

However, a governance system based on zero-sum games is an unstable structure that moves to the left or to the right as the power of the game parties changes, a structure that, right from day one, determines the convergence of power to the strongest side of the game leading to the collapse and reconstruction of order over and over again. The Shield protocol is such a non-cooperative game network, as shown in this graph:

Shield’s decentralized network is maintained by four key constituents: broker, private pool LP, public pool LP and liquidator. The transmission is executed via the governance token – SLD.

Broker (responsible for bringing in trades): Consists of 4 levels, where traders are introduced to the network via competition to earn commissions, with different commission rates for different levels. C and D levels will take out 10% and 20% of the commission rates respectively into the reward pool. Every 30 days, 60% and 40% of the reward pool will be divided equally between the A and B brokers, and the ranking will be reset based on the latest ranking.

Private Pool LP (Order Seller): Featured one address for one private pool, with each private pool competing with each other to provide liquidity (competing to be an option seller) to earn funding fees and SLD rewards for order taking liquidity.

Public pool LP (Backup pool): A unified large liquidity pool that earns liquidity mining rewards by competing to provide guaranteed liquidity.

Liquidators (provide liquidation): compete to perform network liquidation tasks and earn liquidation rewards.

Each aspect of the network has a clear interest incentive and sufficient competition mechanisms, so they all perform the needs of the network for their own benefit. Thus they reach the optimal Nash equilibrium of the whole network to maintain the decentralized security and stability of the network.

Dive Into Tokenomics for long-term Value

The key to a decentralized and stable network is to deliver sufficient and reasonable incentives to each of the players maintaining the network through the value vehicle of a token.

Shield has designed the following mining incentives for the public pool LPs, private pool LPs and liquidators who maintain the network:

- Reserve liquidity mining: each block that provides liquidity to the public pool will be rewarded with a “liquidity share*32” in SLD.

- Order taking liquidity mining: liquidity from either from private pool or public pools will be rewarded with the SLD of ” order funding fee * 30%/0.05″ upon order taking.

- Liquidation mining: liquidators will receive the SLD liquidation compensation reward of “Liquidation with Ether system Gas fee*150%/0.05” (in case of insufficient system fund) as well as the liquidation contest SLD reward.

The mining rewards will be halved for every 20% of the remaining mining share.

Shield generates a buyback price by maintaining 10% of the total SLDs in circulation as always equal to 100% of the value of the buyback pool (derived from 90% of the transaction fees), while the SLDs mined are redeemed by swap&burn contract (as shown above).

When the secondary market price of SLDs is higher than current swap price, then the value of Swap&Burn pool will keep going up, because no one will swap.

When the secondary market price falls back below current swap price, anyone can buy SLDs on the secondary market to earn the difference from this Swap&Burn pool, thus ensuring a minimum price in the secondary market price (this minimum price is similar to the price in stock valuation through PE valuation).

While the transaction fees on the left side Swap&Burn pool increases with the development of the business model, the right side of the SLD pool will deflate as burn and mining rewards halve. Therefore, the value of SLDs will continue to rise in the long run.

Conclusion

Shield is the first decentralized derivatives network with non-cooperative game theory. Each player who helps maintain the network is fully incentivized. And the redemption of the token is accomplished through an innovative Swap&Burn model. Under the logic of uncapped business growth, i.e. uncapped growth in the value of Swap&Burn and continued deflation of the passes used to redeem value as they are destroyed and mined by half, the value of Shield’s native token, SLD, has long-term value potential.

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.

Comments

Post a Comment