A UBS survey finds that central bankers see benefits in investing in cryptocurrencies like bitcoin. 28% see benefits from cryptocurrency being an uncorrelated asset and “11% would consider it as an alternative to gold.”

Central Bankers See Benefits in Investing in Cryptocurrencies Like Bitcoin

The 27th Annual Reserve Management Seminar Survey by UBS explores the prospects of cryptocurrencies as investments for central banks. This survey, conducted between April and June, questioned central bankers from close to 30 central banks in all regions globally, UBS explained. According to Switzerland’s largest bank, this survey “is among the most authoritative depictions of official reserve management activities available.”

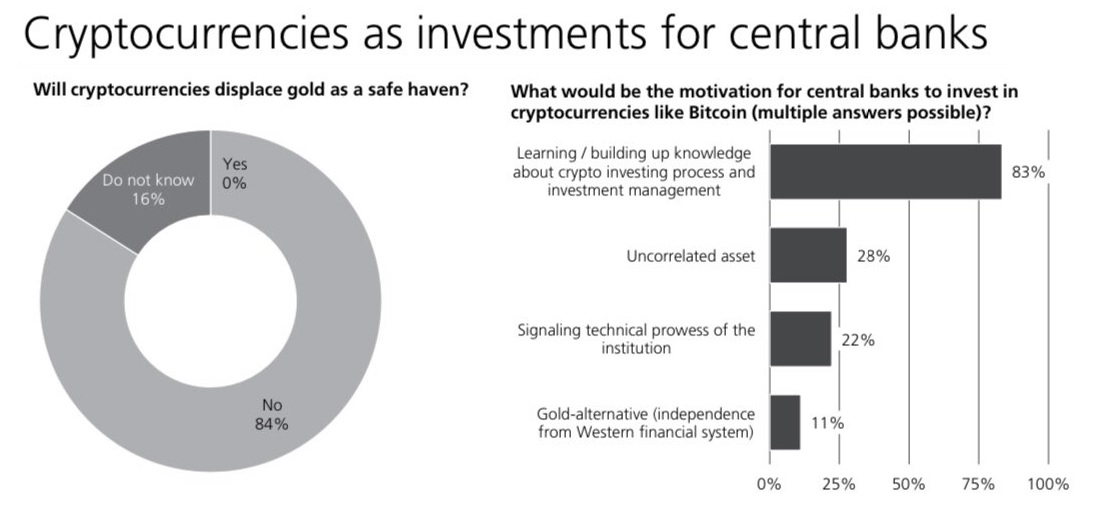

Central bankers were asked what the motivation for central banks to invest in cryptocurrencies like bitcoin would be. The most popular answer was “Learning/ building up knowledge about crypto investing process and investment management.” UBS described, “83% of participants believe that the learning process itself of investing and managing this new asset class would be valuable for their institution.”

The second most popular answer was “Uncorrelated asset.” The third was “Signaling technical progress of the institution.” Another common answer was “Gold alternative (independence from Western financial system).” UBS wrote:

28% of participants see benefits coming from cryptocurrencies as an uncorrelated asset, and a further 11% would consider it as an alternative to gold.

Central bankers were also asked specifically whether they see cryptocurrencies displacing gold as a safe haven asset in the future. Among respondents, 84% said no, 0% said yes, and 16% said they did not know. “A majority of 84% of participants do not believe that cryptocurrencies will displace gold as a safe haven,” UBS noted.

The survey also asked central bankers about central bank digital currencies (CBDCs). 46% of respondents indicated that CBDCs and cryptocurrencies will co-exist, noting that bitcoin and other cryptocurrencies will not be displaced by central bank digital currencies. Meanwhile, 33% believe that CBDCs will displace cryptocurrencies.

What do you think about this survey? Let us know in the comments section below.

Comments

Post a Comment