A class-action lawsuit has been filed against cryptocurrency exchange Coinbase, its executives, and investors over the company’s direct listing on Nasdaq. “According to the complaint, the registration statement and prospectus used to effectuate the company’s offering were false and misleading,” the lawsuit alleges.

Class Action Lawsuit Against Coinbase

- Scott+Scott Attorneys at Law LLP announced Friday that it has filed a securities class action lawsuit against Coinbase Global Inc. (NASDAQ: COIN), with Donald Ramsey as the lead plaintiff.

- The lawsuit also names several Coinbase directors and officers, including CEO Brian Armstrong, as defendants. Other defendants include venture capital firms and investors that benefited from Coinbase’s direct offering, including Marc Andreessen, Fred Ehrsam, Fred Wilson, AH Capital Management, Tiger Global Management, Union Square Ventures, and Viserion Investment.

- Coinbase is the largest cryptocurrency exchange in the U.S. According to its website, the company currently has approximately 56 million verified users, 8,000 institutions, and 134,000 ecosystem partners in over 100 countries.

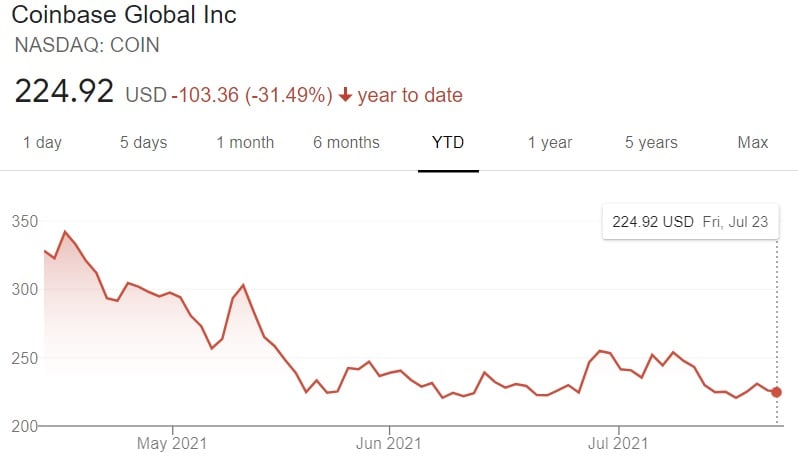

- The company went public on April 14 through a direct listing on Nasdaq, making available 114,850,769 shares of its Class A common stock to the general public. Coinbase’s shares began trading on the Nasdaq exchange at $381 per share.

- The law firm explained:

According to the complaint, the registration statement and prospectus used to effectuate the company’s offering were false and misleading.

- Moreover, Coinbase allegedly “omitted to state that, at the time of the offering,” it “required a sizeable cash injection” and its “platform was susceptible to service-level disruptions, which were increasingly likely to occur as the company scaled its services to a larger user base.” In addition, the lawsuit claims that “as a result of the foregoing, the positive statements about the company’s business, operations and prospects were materially misleading and/or lacked a reasonable basis.”

- The lawsuit further states:

As the truth about the company’s need to raise cash and its platform’s limitations reached the market, the value of Coinbase’s shares declined dramatically.

What do you think about the lawsuit against Coinbase, its executives, and investors? Let us know in the comments section below.

Comments

Post a Comment