While Binance has had a few issues with payment service providers and regulators from a few countries, the centralized cryptocurrency exchange is still the largest trading platform in terms of trade volume. During the last 24 hours, Binance has recorded roughly $8.6 billion in swaps and the trading platform commands the highest trade volume out of all the derivatives exchanges worldwide.

Binance’s Trading Platform Towers Over Competitors

The cryptocurrency exchange Binance is the largest crypto trading platform in the world, in terms of trade volume on both spot and derivatives markets. Binance has been in numerous headlines in recent times as it has been dealing with regulatory complaints from government entities and financial institutions like Barclays and Santander.

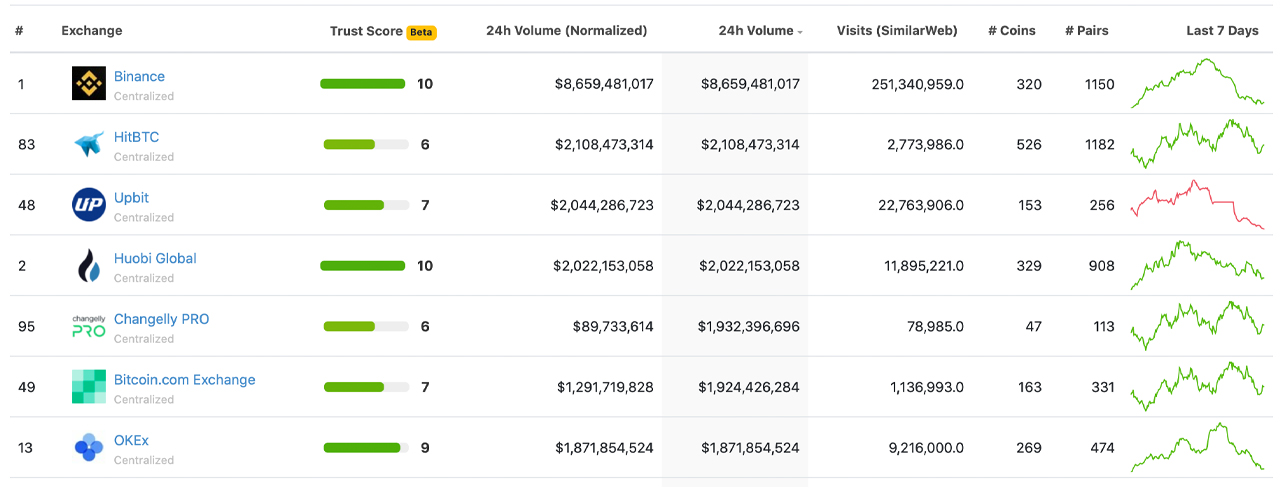

Despite all the negativity, the crypto asset exchange still dominates the pack in regard to the myriad crypto trading platforms worldwide. Binance holds the highest 24-hour crypto trade volume and at the time of writing, it commands $8.6 billion in swaps. The trading platform deals with 320 cryptocurrencies in total and 1,150 pairs.

The $8.6 billion doesn’t account for the United States either, as Binance also operates a separate trading platform for U.S. residents. At the time of writing, Binance US captures $202 million in global trade volume with 53 cryptocurrencies and 110 pairs.

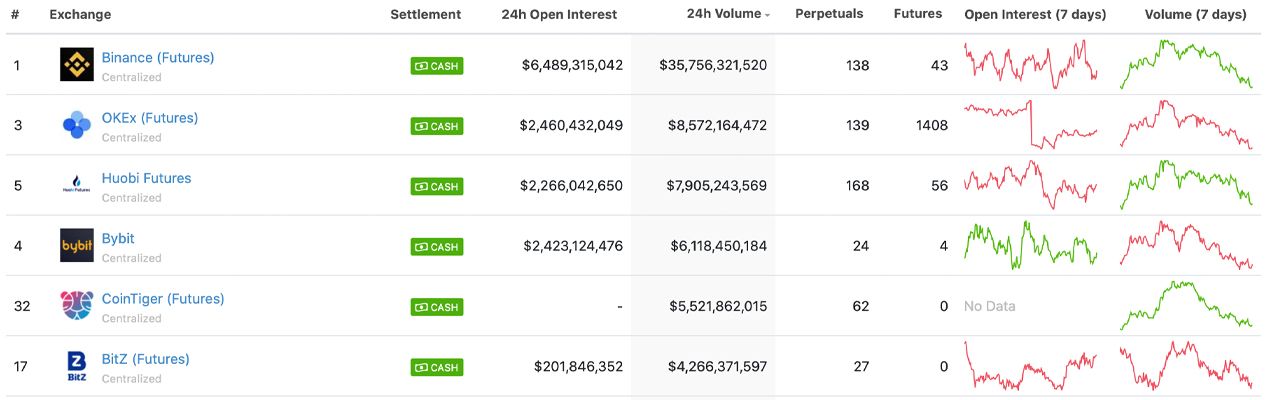

Binance also commands the most trade volume in crypto derivatives markets as the platform’s cash-settled cryptocurrency futures has $35 billion in global volume on Monday. In terms of 24-hour trade volume, there are not that many exchanges that even come close to Binance.

Where cryptocurrency spot markets are concerned, Hitbtc commands the second-largest position in terms of daily trades. However, Hitbtc’s $2.1 billion is 75% less than Binance’s spot market volume. Hitbtc’s spot volume is followed by Upbit ($2B), Huobi ($2B), Changelly ($1.93B), Bitcoin.com Exchange ($1.92B), and Okex ($1.87B).

Binance Derivatives Commands $35 Billion in Volume, Transparent Exchange Balance Rankings Show Binance Holds $14 Billion in Reserves

Moving on to cryptocurrency derivatives exchange volumes, Binance once again takes the lead. With a whopping $35 billion in 24-hour futures volume and $6.4 billion in open interest, no other exchange comes close to Binance. Following Binance in derivatives exchange volume is Okex with $8.5 billion in 24-hour volume and $2.4 billion in open interest. Binance and Okex are followed by Huobi ($7.9B), Bybit ($6.1B), Cointiger ($5.5B), Bitz ($4.2B), and FTX ($4.1B).

Binance’s cash-settled derivatives exchange offers 43 futures and 138 perpetuals in comparison to Okex’s 139 perpetuals and 1,408 futures products. The cryptocurrency exchange Binance doesn’t stop with just crypto spot and derivatives offerings either, as the company also operates a decentralized exchange (dex). While Binance is the largest centralized crypto spot exchange and derivatives platform, the company’s Binance Dex holds the 32nd position among the top dex platforms today.

Binance Dex pulls in $3.5 million in global trade volume between 105 coins and 158 trading pairs. The firm’s dex also saw 12,869,668 unique visitors on Monday and the top trade is currently BNB/BUSD. Still, by market share by volume, Binance only captured 0.1% of all the dex trade volumes during the last 24 hours.

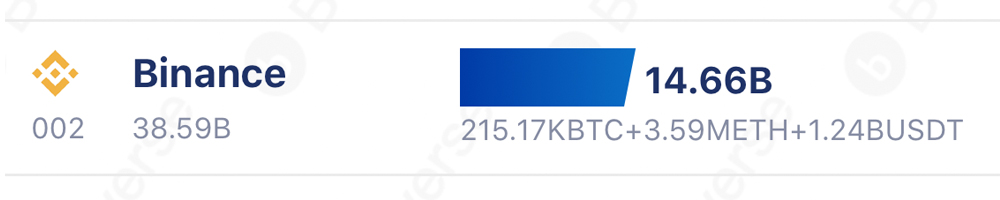

Despite Binance having numerous issues over the last few weeks and all the negative headlines, the company is still a major force to be reckoned with in terms of crypto spot and derivatives volumes. Another thing people may not know about Binance is that the platform is the second-largest crypto exchange in terms of reserve balances.

Only Coinbase towers over Binance with $34.75 billion in BTC and ETH reserves. However, between BTC, ETH, and BUSD, data from Bituniverse shows Binance holds a massive $14.66 billion in crypto reserve assets on July 19, 2021.

What do you think about Binance and the platform’s performance while it has been scrutinized by regulators and financial institutions? Let us know what you think about this subject in the comments section below.

Comments

Post a Comment