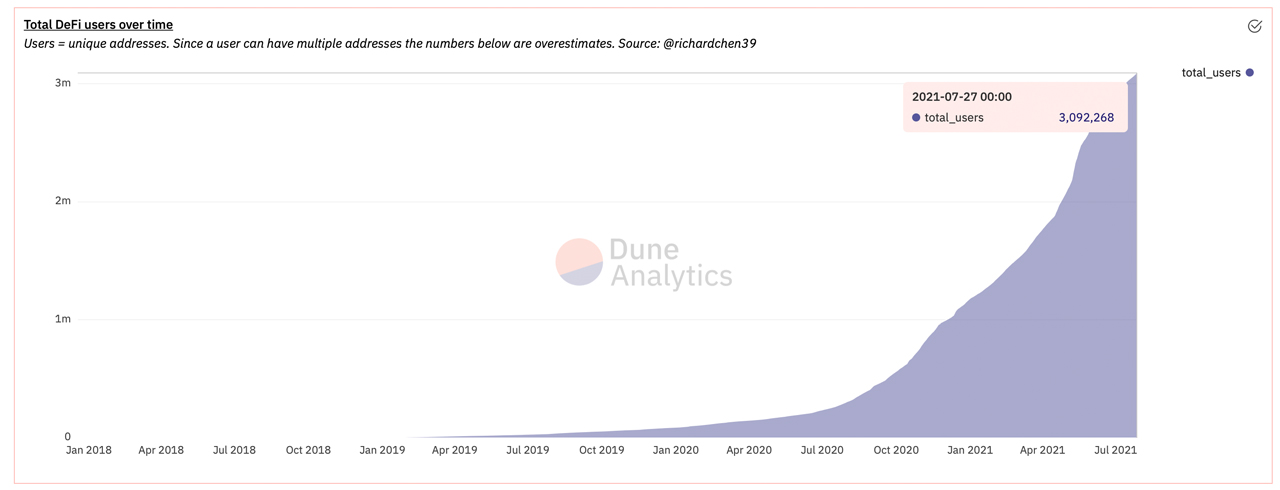

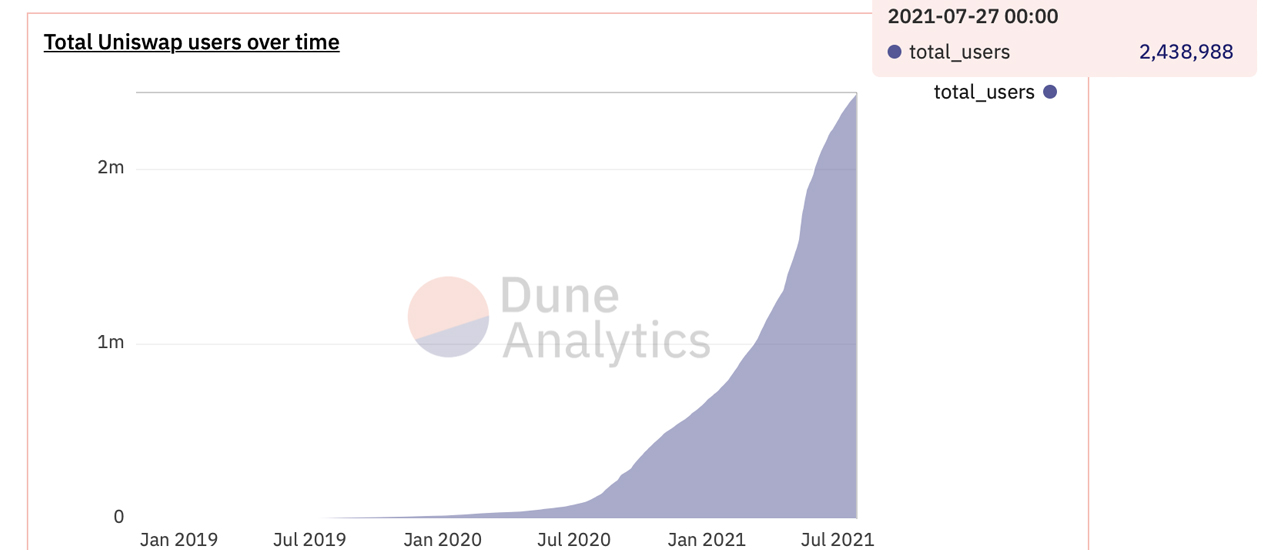

The number of users or unique addresses leveraging decentralized finance (defi) protocols via Ethereum has risen past 3 million according to recent statistics. A vast majority of these unique addresses use the defi protocol Uniswap, as 2.4 million users have been recorded since December 2018.

Ethereum Defi Applications See Unique Addresses Surpass 3 Million

According to statistics from Dune Analytics, the number of users or unique ethereum addresses utilizing defi has jumped past the 3 million threshold this week. At the time of writing, data shows there are 3,092,000 unique addresses recorded on July 27. The lion’s share of these addresses stems from the decentralized exchange (dex) platform Uniswap.

Uniswap’s dex currently has approximately 2,438,374 unique addresses that leverage the Uniswap trading protocol. It’s worth noting, however, that since a user can have more than one unique address, records could be considered overestimates. Further, the data from Dune Analytics’ “Defi Users Over Time” chart only captures a snapshot of Ethereum-based defi apps.

The defi lending application Compound holds around 326,723 addresses on Tuesday and the liquidity protocol 1inch has around 276,924 unique addresses. Behind Uniswap, Compound, and 1inch, are defi apps like Sushiswap, Balancer, and Kyber, respectively.

Total Value Locked Jumps $10B, Dex Volume Grows, Defi Tokens Gather Double-Digit Gains

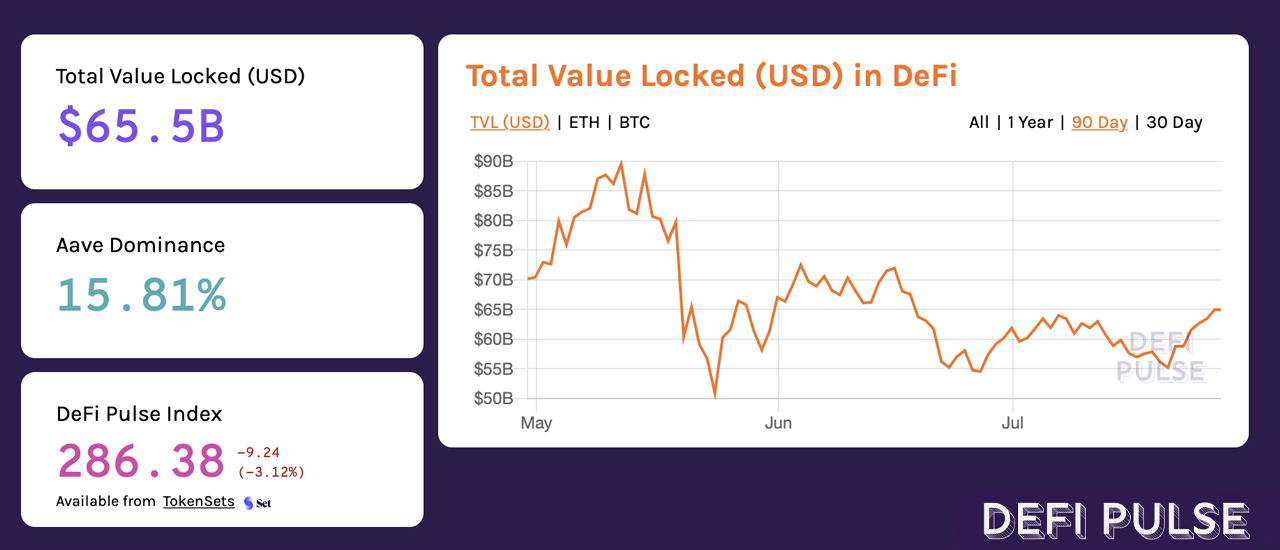

While cryptocurrency markets saw some price recovery this week, defi crypto assets saw significant increases. Seven days ago, the total value locked (TVL) across a myriad of defi applications recorded by defipulse.com shows the TVL was around $55 billion. The TVL metric has since increased to the current $65 billion recorded on July 27.

Decentralized exchange (dex) statistics show that there was $2.33 billion in trade volume recorded on popular dex platforms over the last 24 hours. Seven-day data indicates $15 billion in global swaps were recorded, and Uniswap captured 64% of that volume.

These stats represent ETH-based dex platforms only. Uniswap’s volume trade volume is followed by Sushiswap (9.6%), Curve (7.8%), and 0x Native (5.5%). Defi tokens stemming from applications like Uniswap, Sushiswap, and Aave saw double-digit gains after BTC’s short squeeze on Sunday evening.

What do you think about the recent defi action over the last week? Let us know what you think about this subject in the comments section below.

Comments

Post a Comment