The price of the axie infinity tokens otherwise known as “shards,” has continued to skyrocket in value capturing fresh new price highs. The asset is changing hands for 10% lower than the all-time high (ATH) captured five days ago reaching $75.73 per unit. Axie infinity’s market valuation has also pushed itself into the top 50 most valuable crypto capitalization positions and currently rests at the 41st spot on Monday.

Axie Infinity Popularity Grows

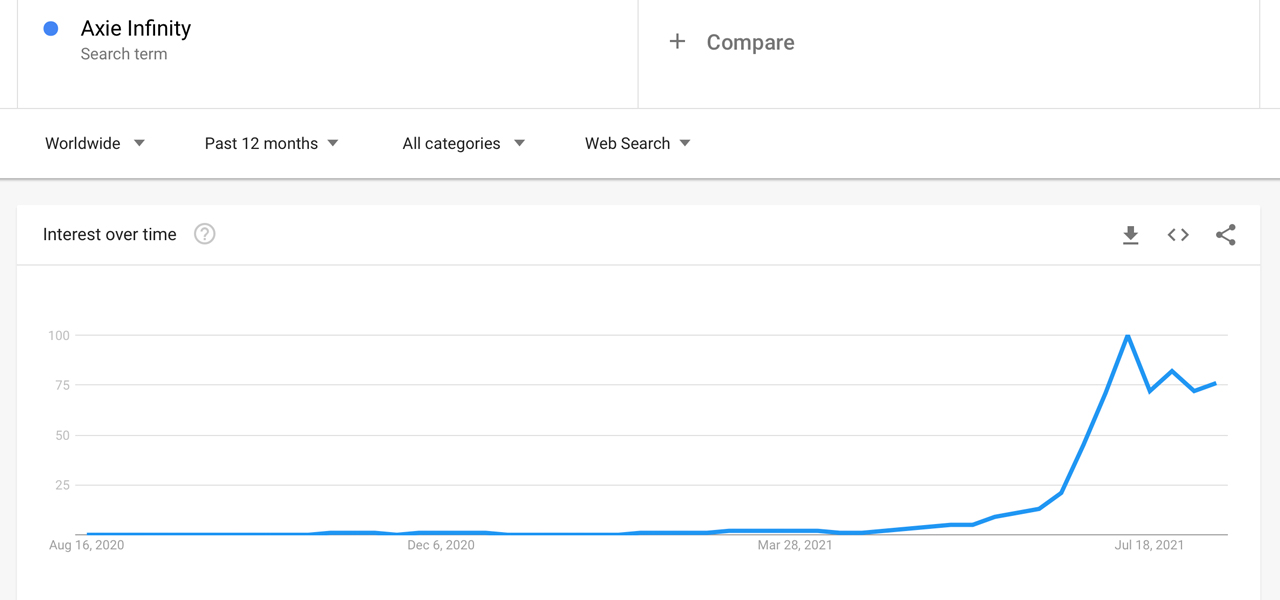

The cryptocurrency project and Ethereum-based gaming community that leverages the Axie Infinity network has continued to trend higher in value and attention. Worldwide 12-months statistics from Google Trends (GT) data show that the search query “Axie Infinity” tapped the highest GT data score a term can get (100) for the week of July 11-17. While search queries stemming from GT data shows searches have waned slightly since then, the search query “Axie Infinity” still commands a high score of 76 at the time of writing.

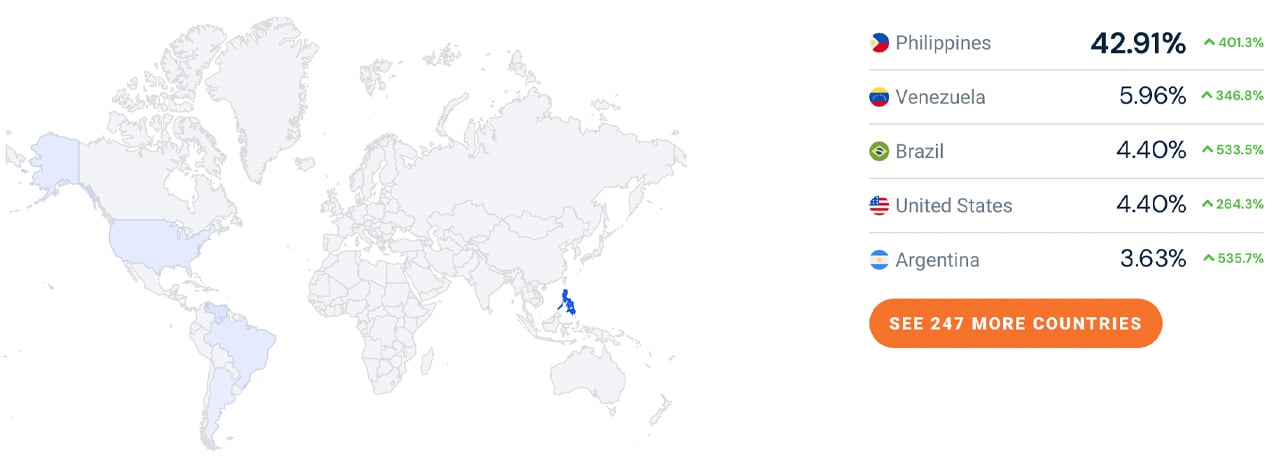

Statistics from similarweb.com indicate that the website axieinfinity.com has seen a 375% increase in traffic and 22.9 million visits. Axieinfinity.com’s website traffic started to spike in April 2021 and has jumped significantly at the end of June. The website is extremely popular in the Philippines this week, and worldwide data shows axieinfinity.com’s global website rank is 1,157. While most of the axieinfinity.com traffic stems from the Philippines, Venezuela, Brazil, the U.S., and Argentina follow, respectively.

AXS Gathers 934% Against the USD in 90 Days, Up 227% Since Last Month

The token axie infinity (AXS) has gained 934.35% against the U.S. dollar and 840.61% against bitcoin (BTC) during the last 90 days. Against the U.S. dollar during the last seven days, AXS is up 56.94%. Two-week statistics show AXS is up 78% and 227% during the last 30 days. The AXS economy is worth $3.9 billion on Monday and there’s $791 million in AXS trades. At the time of writing, a single AXS token is trading hands for $67.96 on August 16.

An analysis of AXS trading pairs on August 16 indicates that tether (USDT) commands 81% of the past 24 hours of axie infinity trades. Meanwhile, pairs like BUSD (10.46%), BTC (4.96%), USD (1.32%) follow in terms of crypto-asset pair volumes with AXS. The other digital asset tied to the Axie Infinity gaming universe called smooth love potion (SLP) is still not doing as well as AXS. While year-to-date data shows SLP is up 308.3%, the gaming rewards token is down 31.0% over the last month.

SLP has lost 14.8% in two weeks and the crypto asset’s ATH ($0.399727) was captured about a month ago on July 13. At $0.175436 per unit on Monday, SLP is down over 55% from the crypto asset’s ATH. The SLP market capitalization is small at $213 million and around $123 million in global trades on August 16. The stablecoin BUSD is the top pair with SLP on Monday as 59.94% of all SLP trades are swapped with BUSD. This is followed by ETH (33.65%), USD (3.74%), and USDT (2.69%).

What do you think about the token axie infinity’s recent market performance and the smooth love potion markets? Let us know what you think about this subject in the comments section below.

Comments

Post a Comment