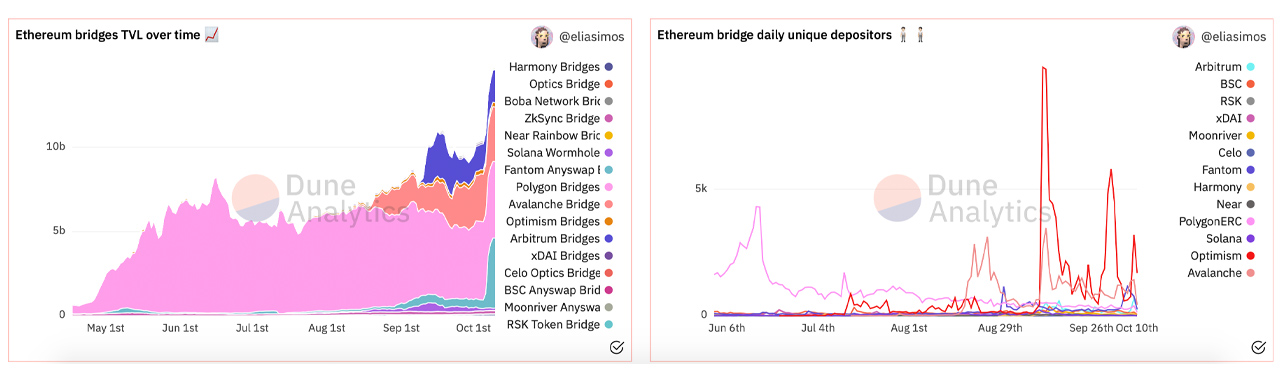

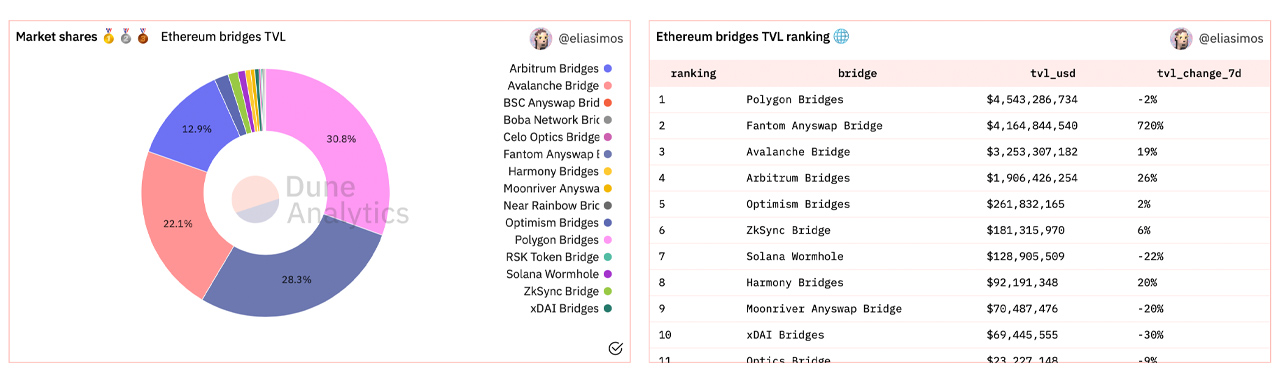

23 days ago on September 16, cross-chain bridges held around $7.79 billion total value locked (TVL) and since then the TVL has increased 89% since then to $14.75 billion. Currently, the top bridges include network connections like Polygon Bridges with $4.5 billion, Fantom Anyswap Bridge with $4.1 billion, and the Avalanche Bridge with $3.2 billion.

Cross-Chain Bridge Technology Swells

Decentralized finance (defi) and cross-chain bridge technology have continued to grow in value this year. A cross-chain bridge allows users to connect to another blockchain, which in most cross-chain cases the other network has been the Ethereum chain, and users can swap assets back and forth between each blockchain.

Last month, Bitcoin.com News reported on an in-depth study that covers the myriad of multi-chain bridges that exist today. At that time on September 16, metrics from Dune Analytics’ “Bridge Away (L1 Ethereum)” dashboard indicated that bridges held $7.79 billion total value locked (TVL).

Since then statistics show the TVL has increased by 89% to $14.75 billion in value today. The “Bridge Away” dashboard shows bridges stemming from Harmony, Optics, Boba, Zksync, Near, Solana, Fantom, Polygon, Avalanche, Optimism, Arbitrum, Xdai, Celo, BSC, Moonriver, and RSK.

Polygon Holds Top Position, Loopring Transfers Are the Cheapest

During the last 30 days, the records measured 121,882 unique addresses associated with these different bridges. At the time of writing, Polygon holds the largest TVL capturing $4.5 billion and the Fantom Anyswap Bridge commands $4.1 billion.

Fantom’s bridge is followed by Avalanche, Arbitrum, Optimism, Zksync, Solana, Harmony, Xdai, and Moonriver respectively. Both WETH and ETH have the top spot in terms of asset rankings while the stablecoin USDC runs in the third position.

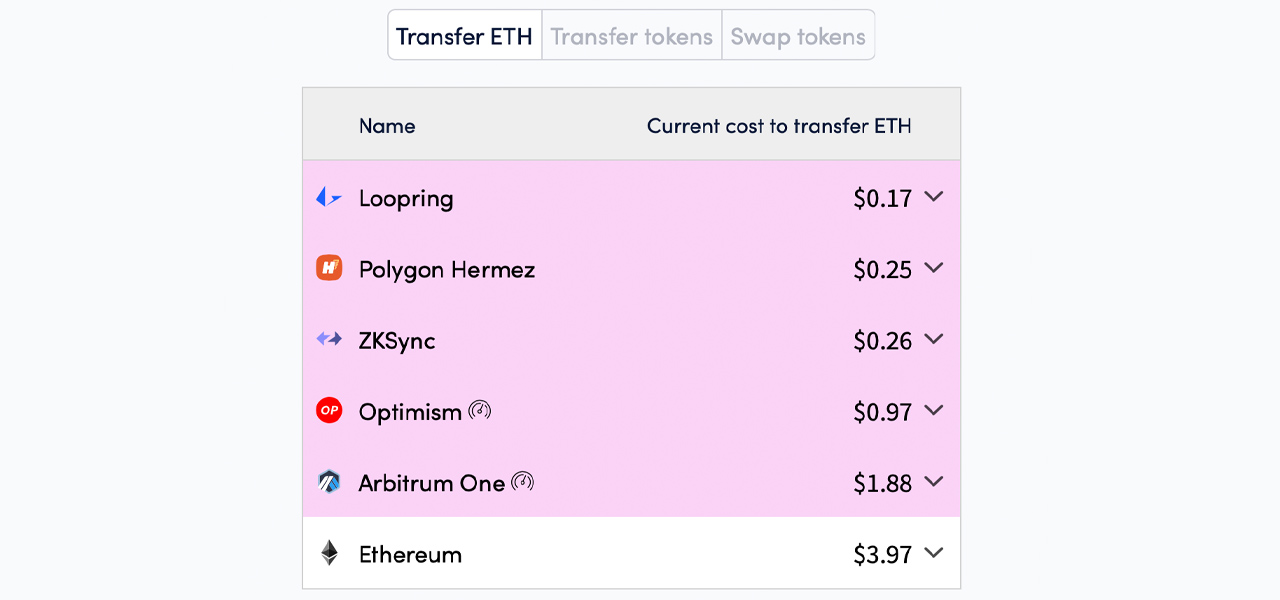

USDC is followed by WBTC, USDT, MATIC, and DAI as far as asset rankings are concerned. Chainlink (LINK) holds the seventh position among the top assets leveraged on cross-chain bridges. Data from l2fees.info indicates that the current cost to transfer ether via Loopring is $0.17 per transaction. Polygon Hermez is $0.25 per transfer, Zksync $0.26, Optimism $0.97, and Arbitrum One is $1.88 per transfer.

What do you think about the cross-chain bridge technology swelling in value and the transfer fees tied to specific Layer 2 (L2) protocols? Let us know what you think about this subject in the comments section below.

Comments

Post a Comment