This week the stablecoin giant tether reached a market capitalization of roughly $78.2 billion according to data. Over the last 30 days, tether’s market valuation grew by 5.6% and the stablecoin now represents 46% of the $168.3 billion stablecoin economy.

Tether Market Cap is Less Than $2 Billion Away From Reaching $80 Billion

On December 30, 2021, there’s roughly 78.2 billion tether (USDT) in circulation, according to coingecko.com’s top stablecoin by market capitalization statistics. According to Tether Limited’s transparency report published to the tether.to web portal, there’s $78.5 billion assets under management. Metrics indicate that tether represents 3.35% of the $2.33 trillion crypto economy today and 46% of the $168.3 billion stablecoin economy.

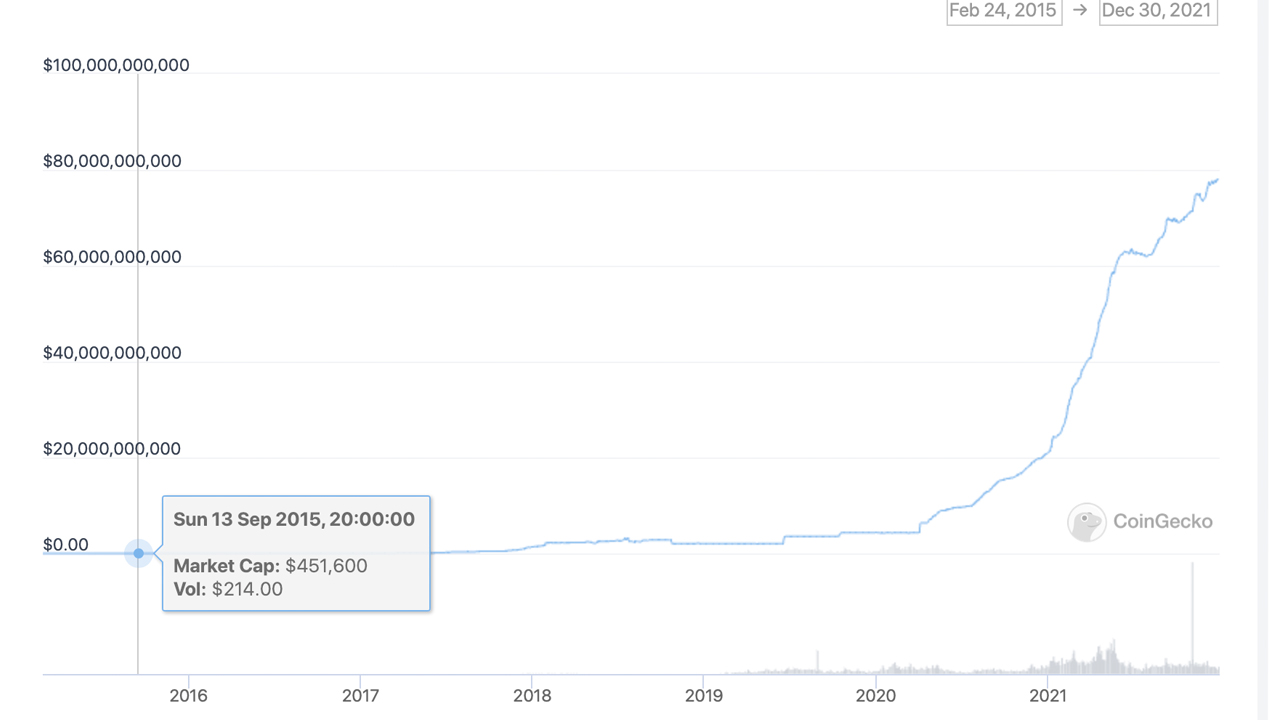

Tether has seen massive growth during its lifetime. For instance, on September 13, 2015, tether’s market capitalization was $451,600 and the jump to $78.2 billion is a whopping 17,327,227% increase in just over six years. The only stablecoin with a comparable market valuation is usd coin (USDC) with $42.1 billion, up 9.7% since last month. USDC represents 1.8% of the $2.33 trillion market cap and is around 52.68% or just over half the size of tether’s market valuation.

The two stablecoins combined represent 71.82% of the entire stablecoin economy and roughly 5.15% of the $2.33 trillion crypto economy. Four stablecoin protocols in the top ten positions of stablecoin market valuations, have increased between 12.9% to 42.9%. BUSD issued by Binance jumped 12.9%, Terra’s UST spiked 34.2%, MIM increased by 30.9% and FRAX swelled by 42.9%.

Tether’s overall valuation is 39% larger than BUSD, UST, MIM, and FRAX combined. Besides being the largest stablecoin in existence today issued across several blockchains, Tether commands the most trade volume as well. Tether’s 24 hour volume is more than BTC’s daily volume today with $52.8 billion in USDT trades. Bitcoin has less than half that volume with $25.5 billion on Thursday.

What do you think about tether’s market cap nearing $80 billion in value? Let us know what you think about this subject in the comments section below.

Comments

Post a Comment