On Nov. 16, 2022, at Bitcoin block height 763,474, someone transferred 6,522 bitcoin worth roughly $107 million after the coins sat idle for more than five years. While bitcoin’s value is 75% lower than it was a year ago, so-called sleeping bitcoins have been waking up amid the recent crypto market capitulation.

While Bitcoin’s Price Remains 75% Lower Than a Year Ago, a Slew of Old Bitcoins Start Moving After Years of Inactivity

Five days ago, 3,500 bitcoin from 2011 were transferred for the first time in 11 Years. Amid the crypto market carnage associated with FTX, old coins have been waking up for some reason, and they have been moving to unknown wallets. For instance, the bitcoin address “1QBG9,” moved 25 BTC at block height 762,719 from an address created on Nov. 13, 2011.

Not too long after that, 50 bitcoin from 2010 were spent on Nov. 14, 2022, after sitting idle for over a decade. The bitcoin address “1LB8B,” which moved the 50 BTC at block height 763,149 was created on May 23, 2010. All three of those sightings were bitcoins stored in addresses that remained idle for more than a decade.

6,522 Bitcoin Worth Over $107 Million Move After More Than 5 Years of Slumber

Two days after the 50 bitcoin from 2010 moved, BTC that derived from an address created on July 31, 2017, moved after sitting idle for more than five years. While that’s not super old, blockchain parsers from btcparser.com caught the individual or entity spend approximately 6,522.40 BTC.

The stash is worth more than $107 million using today’s BTC exchange rates. The bitcoin address “1LVBn” is also connected to close to 10,000 BTC first accrued in an address created on May 29, 2011. When the “1LVBn” bitcoin address was created on July 31, 2017, bitcoin was trading for $2,875 per unit according to statmuse.com metrics.

That means the cache of 6,522 bitcoins was only worth roughly $18.7 million before it went to sleep for more than five years. If the stash of 6,522 bitcoins were sold today, the owner would have profited by more than 472%.

If it was the same owner that acquired approximately 9,478.77 BTC on May 29, 2011, the individual could have acquired the bitcoins at $8.30 per unit. At that price in the spring of 2011, the person could have gained roughly 1,189% in profit against the U.S. dollar over 11 years.

Owner Sends Cache of Bitcoins With Zero Privacy Techniques to 2 Addresses

The funds, however, don’t look as though they were sent to an exchange, according to onchain data, as the 6,522 bitcoins now reside in two different addresses. The change address “1AkJq” holds 6,061.83 BTC, and 460.57 BTC went to the address “bc1qt.” The net send of 6,522 bitcoins remains idle at the time of writing.

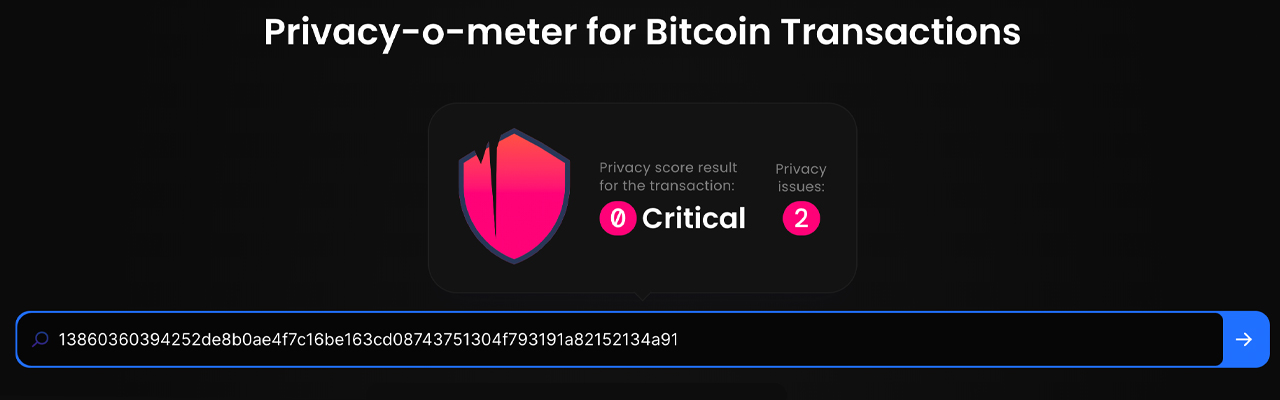

Throughout the history of the 6,522 BTC spent on Nov. 16, 2022, the transactions have never been sent in a private fashion. Blockchair.com’s privacy tool gives the last change transaction, which moved 6,061.83 BTC, a privacy rating of “0” or “critical.”

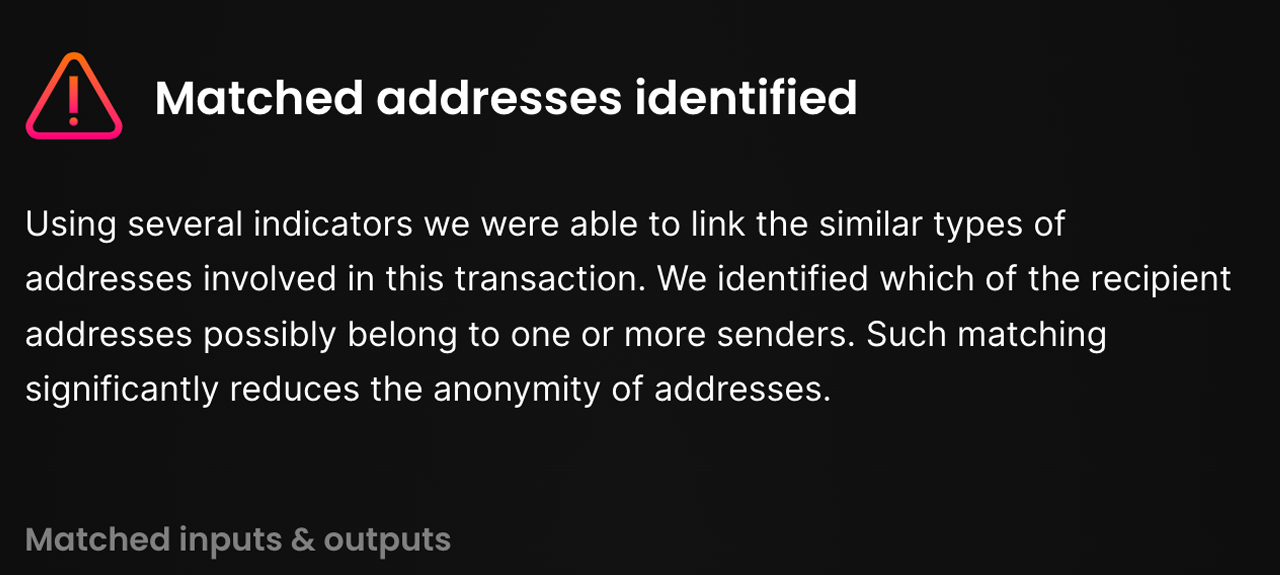

Every time the owner of these bitcoins moved coins, matched inputs and outputs were discovered making it easily identifiable by blockchain analysis. It’s worth noting that the technical term “spent” and the use of the word “change” in this article do not necessarily mean the bitcoins were sold.

In fact, they simply could be transferred to alternative addresses by the same owner. It’s also worth noting that the bitcoins that originated from the wallet on May 29, 2011, which are also associated with the 6,522 BTC spent on Nov. 16, 2022, may have seen ownership change hands either on or off the blockchain.

The owner of the bitcoin address did not spend the corresponding bitcoin cash (BCH) associated with the “1LVBn” bitcoin address. 6,522.40 BCH remains in the address at the time of writing and the BCH is worth roughly 680,939 nominal U.S. dollars.

What do you think about the 6,522 bitcoin that woke up after five years and three months? Let us know what you think about this subject in the comments section below.

Comments

Post a Comment