Bitcoin’s Mining Difficulty Taps a Lifetime High, Glassnode Says BTC Miners Remain ‘Under Immense Pressure’

On Sunday, Nov. 20, 2022, Bitcoin’s difficulty rise erased the recent 0.20% decline recorded two weeks ago, as the difficulty metric rose by 0.51% at block height 764,064. The increase on Sunday has pushed the difficulty rating to another all-time high, from 36.76 trillion to the current 36.95 trillion.

Bitcoin Difficulty Reaches All-Time High Nearing 37 Trillion, Leading Crypto Asset’s Fiat Value Sinks Lower

Today it is 0.51% more difficult to find a Bitcoin (BTC) block reward than it was for the last two weeks or 2,016 processed blocks. The 0.51% increase has propelled the difficulty to a lifetime high at 36.95 trillion, outpacing the previous high recorded on Oct. 23, 2022. The difficulty increased during this retarget because block intervals were less than the ten-minute average, at nine minutes and 58 seconds. The average hashrate for the last 2,016 blocks was around 264.3 exahash per second (EH/s).

On Sunday, around 7:15 p.m. (ET), the global hashrate is around 261.29 EH/s and eight days ago on Nov. 12, 2022, at block height 762,845, Bitcoin’s hashrate tapped an all-time high at 347.16 EH/s. The next difficulty adjustment is due on or around Dec. 4, 2022, and the current block generation time following the change is nine minutes and 26 seconds. The difficulty change is not good for bitcoin miners and BTC’s current fiat value isn’t helping miners either.

Hash Price per Exahash Slides, Bitcoin Miners Deploy 8.25K Bitcoin to ‘Shore up’ Balance Sheets

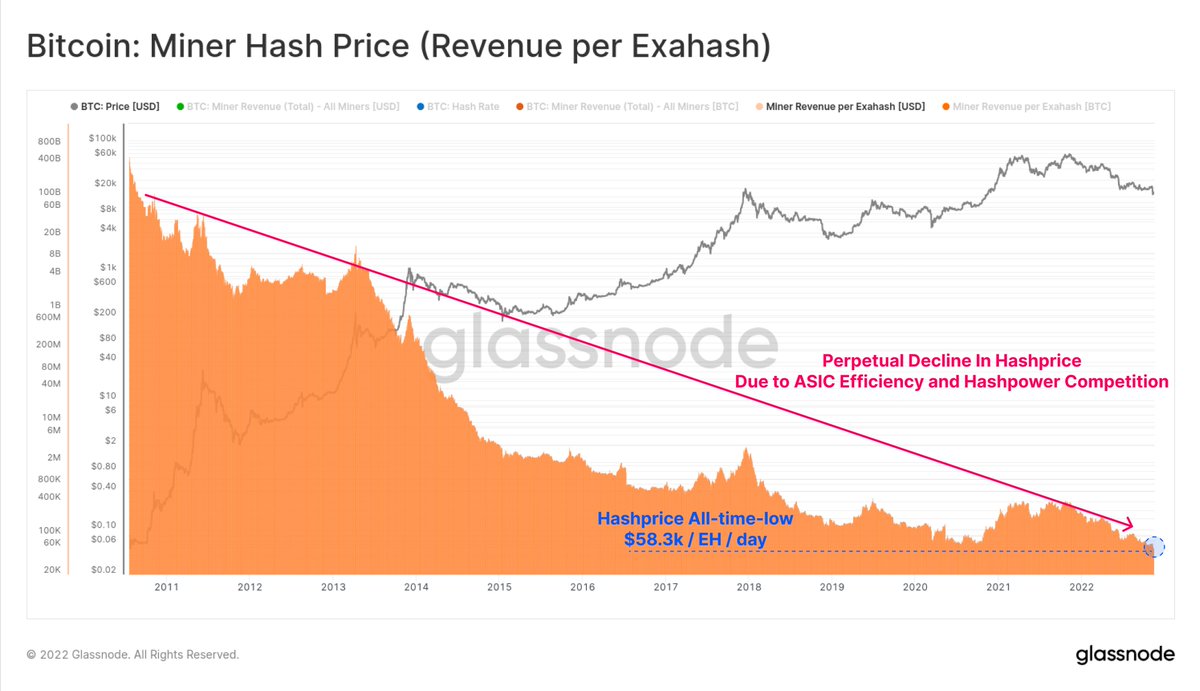

Bitcoin’s current value is more than 76% lower than the all-time high recorded on Nov. 10, 2021. The onchain analysis firm Glassnode explained on Nov. 18, 2022, that the bitcoin miner hash price has dropped to a lifetime low. “[Bitcoin] miner hash price has plunged to a new all-time low of $58.3k per exahash per day,” Glassnode tweeted. “With [bitcoin] prices now down over 76% from the peak, the mining industry remains under immense pressure,” the firm added.

Since Glassnode’s tweet, the hash price per exahash has dropped even lower on Nov 20. “As news of the FTX fallout broke last week, bitcoin miners distributed an additional 8.25K [bitcoin] to shore up their balance sheets. This leaves around 78K [bitcoin] in miner treasuries, and erases all balance growth in 2022,” Glassnode added. Three-day statistics recorded on Sunday show that Foundry USA has been the top mining pool with around 71.76 EH/s or 27.36% of the global hashrate.

Foundry is followed by Antpool’s 46.43 EH/s, F2pool’s 40.40 EH/s, and Binance Pool’s 37.99 EH/s. Foundry, Antpool, and F2pool are followed by Viabtc and Braiins Pool, respectively. There are 13 known mining pools dedicating hashrate to the BTC chain, and unknown hashrate otherwise known as stealth miners, command 2.76% of the global hashrate or 7.24 EH/s. Miners successfully mined 435 bitcoin blocks which equates to 2,718.75 freshly minted BTC worth $44 million, and the fees associated with those blocks.

What do you think about Bitcoin’s mining difficulty rising by 0.51% on Sunday evening? Let us know what you think about this subject in the comments section below.

Comments

Post a Comment