Fed President Warns of ‘Disastrous Results’ if the Fed Loosens Policy Prematurely — Says ‘Inflation Remains Too High’

Federal Reserve Bank of Atlanta’s president has warned of disastrous economic consequences similar to those seen during the financial crisis of the 1970s if the Fed loosens its policy prematurely. Noting that “inflation remains too high,” he stressed: “We don’t want a repeat, so we must defeat inflation now.”

Fed Officials on Rate Hikes and Inflation Fight

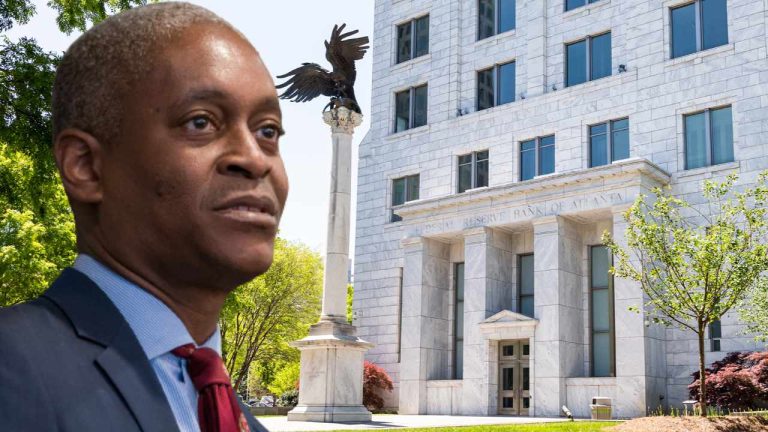

The president of the Federal Reserve Bank of Atlanta, Raphael Bostic, warned about “disastrous” economic consequences should the Fed loosens its policy prematurely in an essay published by the Atlanta Fed on Wednesday.

“I believe inflation remains too high,” he wrote, emphasizing the need for the Federal Open Market Committee (FOMC) to raise interest rates more aggressively. Commenting on a narrative that the Federal Reserve should consider “reversing its course of raising the federal funds rate lest we go too far and cause undue economic hardship,” Bostic opined:

While that perspective is understandable, history teaches that if we ease up on inflation before it is thoroughly subdued, it can flare anew. That happened with disastrous results in the 1970s.

“After the FOMC loosened policy prematurely, it took about 15 years to bring inflation under control, and then only after the federal funds rate hit 20%,” the Atlanta Fed president warned. “We don’t want a repeat, so we must defeat inflation now.”

Bostic continued, “Now we must determine when inflation is irrevocably moving lower,” elaborating:

We’re not there yet, and that is why I think we will need to raise the federal funds rate to between 5% and 5.25% and leave it there until well into 2024.

“This will allow tighter policy to filter through the economy and ultimately bring aggregate supply and aggregate demand into better balance and thus lower inflation,” he said.

Federal Reserve Bank of Minneapolis’ president, Neel Kashkari, also talked about interest rate hikes at a business event in Sioux Falls on Wednesday. Kashkari said he is “open-minded” about whether the Fed will raise interest rates by 25 or 50 basis points at the next FOMC meeting. Citing last month’s data of “higher inflation than we expected and a strong jobs report,” Kashkari said:

These are concerning data points suggesting we’re not making progress as quickly as we’d like.

However, he cautioned against overreacting to “one month of data even if the data is troubling.”

Do you think the Fed should be more aggressive in hiking interest rates to fight inflation? Let us know in the comments section below.

Comments

Post a Comment