In the past 20 days, the Arbitrum blockchain has recorded a significant number of transactions coinciding with the recent ARB airdrop that occurred on March 23. About two weeks ago, on that day, the Arbitrum network recorded an all-time high of 2.72 million transactions settled in 24 hours.

L2 Network Arbitrum Records 2.72 Million Transactions in a Single Day, Transfer Count Remains Parallel With Ethereum’s Daily Rate

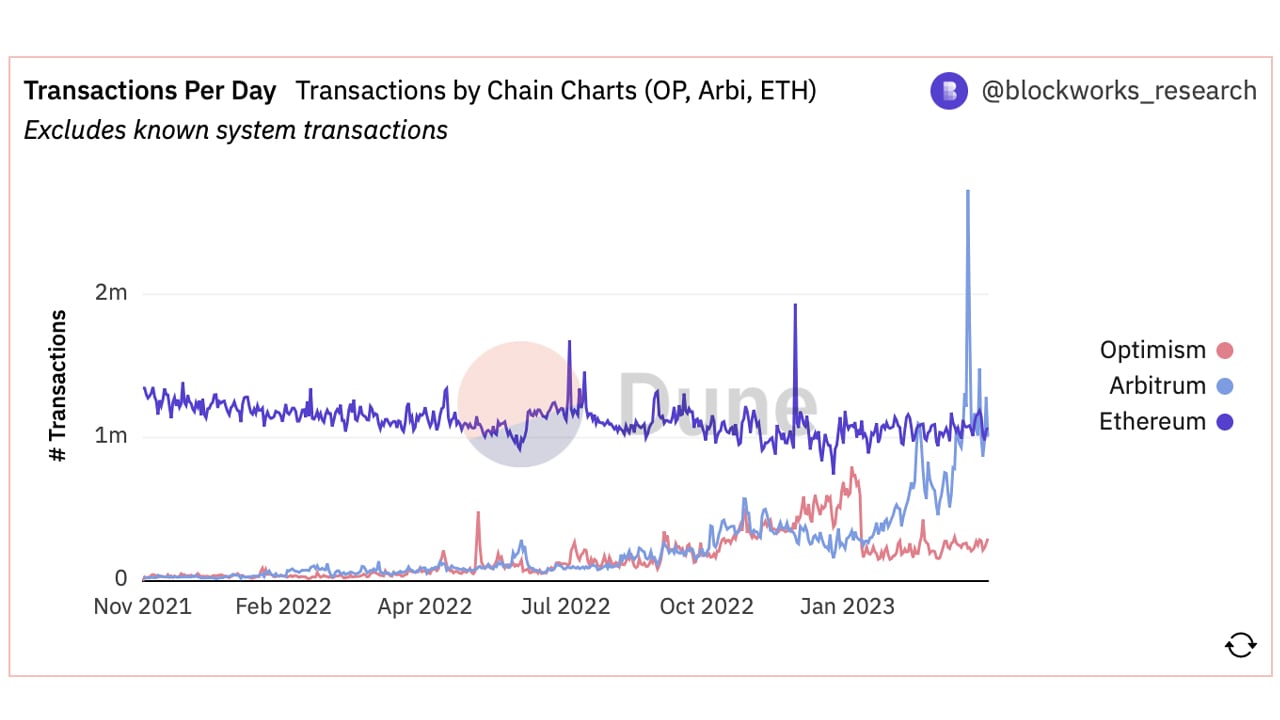

The Ethereum Layer 2 (L2) scaling solution, Arbitrum, has seen a significant amount of activity over the last 20 days or since March 16, 2023. The surge in activity follows Arbitrum outpacing Ethereum’s number of transactions per day for the first time 41 days ago, on February 23, 2023. After the milestone on February 23, Arbitrum’s transactions per day (TPD) dropped below Ethereum’s TPD until March 16.

At that time, Arbitrum’s TPD once again surpassed Ethereum’s TPD, and the network reached its all-time high (ATH) on March 23. That was the same day the ARB airdrop took place, and 1.275 billion ARB was distributed across the ecosystem. The Arbitrum blockchain recorded 2.72 million transactions, while Ethereum recorded 1.07 million.

As far as the L2 scaling project Optimism is concerned, the network has seen roughly 150,000 to 430,000 transactions per day. When Arbitrum recorded the 2.72 million TPD, Optimism saw just over 228,000 transactions on the same day. Since the Arbitrum TPD ATH, the network has seen around 1 million TPD since then, according to Dune Analytics data.

Statistics show that the current cost to transact on the Arbitrum network is $0.33 per transaction, while the median-sized Ethereum network transaction cost is 0.0018 ETH or $3.47 per transfer. Arbitrum’s native token, ARB, has been trading for prices between $1.22 to $1.28 per unit.

ARB has an overall market capitalization of around $1.5 billion, and ARB is ranked 40th among the top crypto market valuations. ARB’s trading volume over the last day has been around $556 million, and presently, the crypto asset is down 85% from its $8.67 ATH. It is also 10% higher than the all-time low of $1.11 per unit recorded 14 days ago.

What are your thoughts on the potential of L2 scaling solutions like Arbitrum to address the scalability issues of blockchain networks? Share your thoughts about this subject in the comments section below.

Comments

Post a Comment