The global crypto market is expanding steadily despite recent bearish sentiments. Over 119 million people worldwide started owning cryptocurrencies in 2022, marking a 39% rise in total ownership. It reflects a growing demand for alternative payment methods and investment instruments.

More people now believe in the potential of futuristic asset classes like crypto. Particularly since innovators are bringing novel utilities to the table. But the road ahead isn’t all rosy. We must overcome several challenges before crypto-based assets bloom fully.

One key issue is the lack of simple, user-friendly, and stable instruments for beginner and pro investors. For instance, index investing, despite its strong track record in traditional finance, is mostly inaccessible to the crypto community. This exposes investors to market-related risks like high volatility, reducing their scope for diversification and generating suboptimal returns.

J’JO provides a solution to these problems with its advanced index-based investment service for crypto markets. Besides making crypto investing safer and more accessible, the service helps improve financial planning for investors across the board.

Why crypto needs simpler investment instruments

Cryptocurrencies have shown a meteoric rise in popularity. This is great from the perspective of how this asset class provides value across industries and market segments. From digital currencies to luxury items and real estate, we now have unforeseen revenue streams and transaction methods.

But the journey to using crypto efficiently involves a steep learning curve. It’s pretty different from legacy assets and traditional investments, though they have some basic principles in common. That’s why most crypto investors, with little or no experience, end up putting money in unreliable, half-baked assets. The volatile markets burn them as a result, often demotivating future endeavors.

This can’t go on. Stakeholders of the nascent crypto industry must ensure long-term adoption. And to do that, we must learn some lessons from our traditional counterparts. Offering easier investments for retail users has been a key to the success of legacy financial systems. Crypto has to up its game in this regard.

Some cryptocurrency exchanges and platforms do offer relevant services. But these are mostly hidden from users due to flawed positioning. J’JO thus launched its service for public use in May 2023, as a response to this crisis. It provides the simplicity, stability, and ease of access that crypto investors need.

J’JO’s service is for everyone, beginner or pro

Boosting financial inclusion has been one of crypto’s main goals from the very beginning. It was the most crucial aspect of Satoshi Nakamoto’s vision for Bitcoin. That’s why J’JO has developed a cryptocurrency index investing platform with an intuitive and hassle-free interface accessible to everyone.

The service leverages a robust index investing principle, i.e., CCi30. Carlo Sevoly, the CS&P President, and Igor Riven, a Temple University & Regis professor, developed this principle in 2017, which now forms the basis for J’JO’s flagship index, JJO35.

JJO35 is a combination of traditional wisdom and expertise with innovation, ensuring the best possible tracking of crypto markets. It algorithmically invests in the top-35 cryptocurrencies by market cap, so that investors can begin their journey in under five minutes.

The service is available in 12 languages across 200 countries worldwide. Investors can thus diversify their portfolios by securely investing in crypto from almost anywhere. They also get multiple payment options, including Visa, Mastercard, and local services.

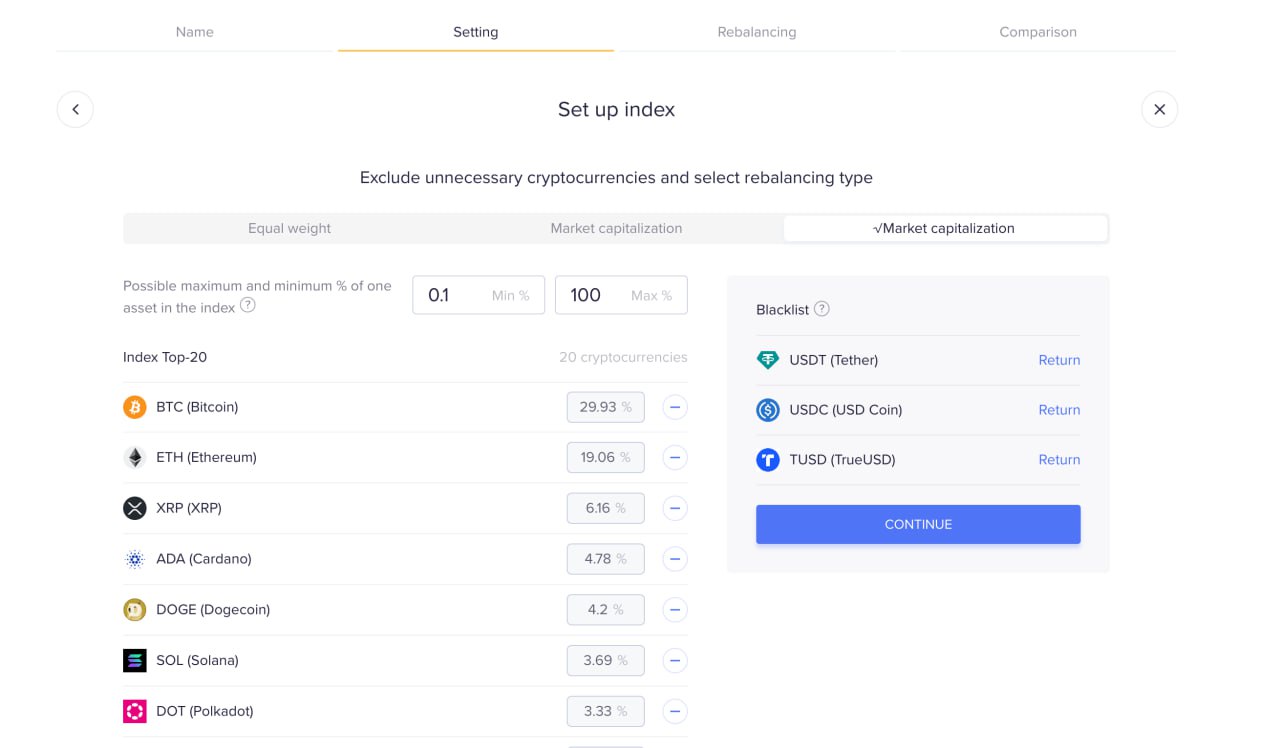

Moreover, J’JO’s API-based architecture connects with all major exchanges, which further heightens its interoperability. These features provide investors with a seamless, user-friendly, and readymade index investing, financial planning, and risk management service. Professional investors can also create custom indices using their favorite cryptocurrencies.

Source: J’JO

Investors remain in control with J’JO

J’JO is a non-custodial platform where investors remain in complete control of their funds. They simply connect users’ exchange accounts to start investing in crypto indices, almost in real time and for free with deposits under $500.

The algorithm automatically analyzes and rebalances funds to minimize the hassle for investors. It thus sells assets that fall off the Top-35 list, reinvesting promptly in new growth leaders. The funds never leave the user’s exchange account since the system functions via APIs. However, professional investors can also use the custom rebalancing and asset tracking settings available on J’JO for even greater control.

Having said that, investors must realize J’JO, like any other market-driven service, cannot predict future outcomes with 100% accuracy. It also doesn’t “guarantee” profits, though historical data shows how JJO35 has grown 5.5x in the past three years, compared to Bitcoin’s 3x growth.

Investors must, therefore, use J’JO with reasonable expectations and a basic understanding of the risks and limitations of crypto investments in general. J’JO isn’t a tool for short-term speculations, but rather an instrument for long-term growth and financial planning.

With that in mind, J’JO users can eliminate guesswork from their investing process to make the most out of cryptocurrencies. This paves the road to the future, which ultimately leads to sustainable adoption of crypto assets and growth for investors.

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.

Comments

Post a Comment