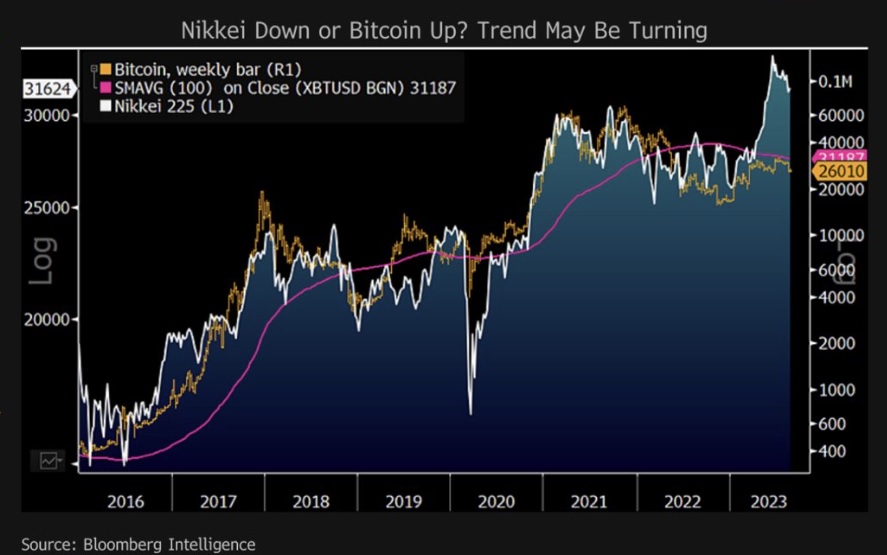

Bloomberg Intelligence’s senior commodity strategist, Mike McGlone, has predicted that the price of bitcoin could “follow the path of the Nikkei, which reached a 33-year high in June.” He highlighted that the largest crypto “has had a close directional relationship with the Nikkei 225.”

Bitcoin’s ‘Close Directional Relationship’ With Nikkei Index

Mike McGlone, a senior commodity strategist for Bloomberg Intelligence (BI), the research arm of Bloomberg, has pointed out similarities between the Nikkei index and the price of bitcoin.

In the latest Bloomberg Intelligence report, the commodity strategist explored whether the Nikkei index or the Nikkei Stock Average (Nikkei 225), the premier index of Japanese stocks, is “a guide for bitcoin or vice versa.” McGlone detailed last week:

Bitcoin has had a close directional relationship with the Nikkei 225, and recent crypto weakness may portend contagion. That or the benchmark crypto might recover and follow the path of the Nikkei, which reached a 33-year high in June.

“Our bias is to heed the leading-indicator inklings of bitcoin and respect the downward-sloping 100-week moving average,” he added. “Sustaining back above about $31,000 would be an indication of bitcoin recovery strength, but there’s good reason for the downward reversion to continue — the Fed and most central banks are still tightening,” the strategist further shared.

McGlone also pointed out the possibility that the Nikkei could track bitcoin’s downward trajectory. “Japan’s close proximity to China and our view that the country is like some combination of Ayn Rand’s ‘Atlas Shrugged,’ peak Japan and the Soviet Union over 30 years ago, with deflation implications, may portend the Nikkei following bitcoin lower,” the strategist described.

He also explained last Wednesday that the downtrend of bitcoin’s price since the 2021 high “may be resuming,” noting that “$30,000 is a key pivot level.” The strategist stressed that “Sustaining back above $30,000 would indicate a reversal upward akin to a similar pattern around $12,000,” which happened in the second quarter of 2020. However, he noted: “A key factor that’s different this time is unfavorable liquidity — most central banks are still tightening and elevating rollover risks in the stock market.”

What do you think about Mike McGlone’s analysis regarding the price of bitcoin and the Nikkei index? Let us know in the comments section below.

Comments

Post a Comment