MasterCard Startpath Member Polytrade Moves to 2.0: Partners With Ondo, OpenEden, Maple, 4K, Goldfinch, and Others to Create Marketplace for RWAs

PRESS RELEASE. Polytrade, a leading real-world asset protocol, is taking a major step in its evolution, demonstrating its unwavering commitment to addressing the critical issues surrounding real-world assets. The platform is changing the way RWAs are aggregated and serves as a comprehensive solution for discovering, tokenizing, and facilitating liquidity for real-world assets.

Though the supply of real-world assets has seen significant improvement in recent times, the challenge remains on the demand side. The real-world asset space needs a dedicated platform purpose-built to facilitate discovery, primary sales, and secondary liquidity. Polytrade is stepping up to fill this crucial void by building an RWA Marketplace, the foremost platform that solves these issues.

Polytrade’s RWA Marketplace will serve as a dynamic hub where diverse assets find their value and participants can confidently interact in a secure environment. The marketplace shall have solutions not just for buyers, but also asset originators and secondary sellers. Assets on the marketplace will include everything that derives value off-chain including treasury bills, real estate, loans, structured finance as well as physical collectibles such as Pokemon cards, watches, sneakers, and other goods. It can be seen as an “OpenSea for RWAs”.

To achieve this Polytrade has partnered with protocols such as Ondo Finance, OpenEden, Goldfinch Finance, 4K, Swarm Markets, Pine, Teller, Clearpool, Maple Finance, Unikura, Atlendis, and others.

By bringing together these protocols and spurring interoperability and usability of the assets beyond simple purchase, Polytrade will create an ecosystem where RWAs can truly flourish. For example, Polytrade is working with protocols such as Teller and Pine to provide collateralized loans on the underlying RWA assets. Polytrade sees more partners emerging in areas such as derivatives, white-label distribution, investment banking, ratings, custody, and more.

In addition, Polytrade is also partnering with multiple chains to bring cross-chain interoperability for RWAs, starting with Ethereum and Polygon but soon expanding into other chains. This is key to matching liquidity supply and demand effectively since most RWA assets currently sit on Ethereum.

“We believe in bringing RWA players together, breaking down silos, and fostering a collaborative environment that benefits everyone. Together, we can create a more inclusive and efficient financial landscape.” – Piyush Gupta, CEO of Polytrade

The first phase will be focused on creating discovery and consideration for all assets and building secondary trading for the collectibles asset class. The launch is expected in December 2023.

Polytrade’s core mission is to empower individuals from all walks of life with the ability to invest in easily accessible assets. Polytrade believes in providing financial freedom to everyone, regardless of their economic background, through equitable access to asset ownership. Tokenized real-world assets are the perfect tool to achieve this mission as they level the playing field for all users, from professions and institutions to individuals in developed and emerging markets. In particular, users in emerging markets in the Middle East, Africa, Asia, and Latin America face an acute shortage of hard currency investment options, which can be addressed by access to these tokenized assets intuitively.

Polytrade has achieved remarkable innovations that have transformed the asset tokenization industry. Polytrade pioneered the tokenization of trade finance and authored the revolutionary ERC-6960 standard. The RWA Marketplace is set to redefine the landscape further.

Polytrade recently announced its participation in Mastercard’s Multi-token Network Innovation Sprint and its selection in the Mastercard StartPath Program. Mastercard has selected 7 startups including Polytrade for its global startup engagement program to scale innovation in blockchain and digital assets.

Link to announcement: [https://twitter.com/Polytrade_fin/status/1704123843181424972]

While Polytrade is moving to its next phase, it continues to stick to its trade finance roots. Trade Finance is the protocol’s long-standing expertise and is the first listed asset class on the RWA Marketplace.

“Polytrade was born out of a realization that core challenges in our current financial systems can be solved using blockchain, leading to not just better capital allocation but the meaningful last-mile impact. As our products mature, we are seeing the applicability of our standards across multiple asset classes,” says Piyush.

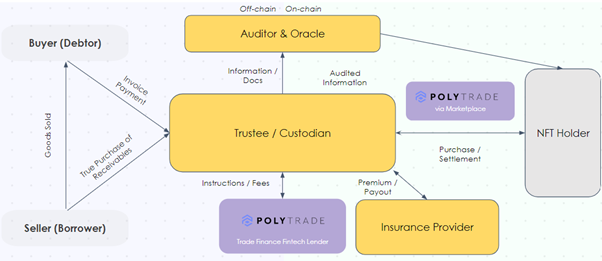

Launched in 2021, Polytrade has been known for bringing the $5T trade finance market on-chain, having funded assets of over $6M. While Polytrade is going beyond its home ground of Trade Finance, it remains a key focus area. One of the key innovations in trade finance is the new structure. Polytrade, for the first time in both TradFi and DeFi, is bringing a bankruptcy-remote trade finance trustee & auditor model. This means tokenized trade finance assets can be serviced directly by a trustee without direct involvement from Polytrade and each data point from insurance coverage, risk rating to yield and the counterparty will be confirmed by an auditor and on-chained via a trusted oracle.

Overall, Polytrade is now gearing up to solve a major roadblock for RWAs as a whole to succeed – the lack of a single platform for users to navigate the world of Real-World Assets. Users can be excited for this next leg of innovation to propel RWAs to the next level. Register for the upcoming marketplace: https://lnk.polytrade.finance/whitelist

Read more about Polytrade 2.0 in this official release note: [https://lnk.polytrade.finance/release-note]

Join Polytrade Communities:

English: https://lnk.polytrade.finance/english

Spanish: https://lnk.polytrade.finance/spanish

SEA: https://lnk.polytrade.finance/Asia

Turkish: https://lnk.polytrade.finance/turkish

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Comments

Post a Comment