Report of SEC’s Spot Bitcoin ETF Advice Fuels Hope for Approval — Crypto Industry Views It as ‘Real Progress’

The Securities and Exchange Commission (SEC) has reportedly provided specific guidance to exchanges seeking to list and trade spot bitcoin exchange-traded funds (ETFs) on what they should do next. “This is real progress,” said one crypto exchange insider. “The cash vs in-kind debate looks to be finding clarity.”

SEC’s Advice Regarding Spot Bitcoin ETFs

Optimism for spot bitcoin exchange-traded fund (ETF) approval by the U.S. Securities and Exchange Commission (SEC) surged again on Friday after a report of the SEC engaging with exchanges to provide guidance on spot bitcoin ETF applications emerged.

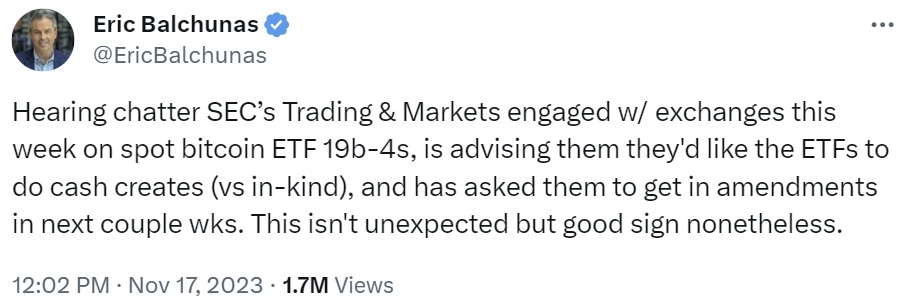

Bloomberg ETF analyst Eric Balchunas shared on social media platform X that he is hearing chatter suggesting that the SEC’s Division of Trading and Markets engaged in discussions with exchanges this week, advising them to use the cash creation method, instead of the in-kind method, for spot bitcoin ETFs. Moreover, the securities regulator reportedly asked exchanges to file amendments to reflect this change in the next couple of weeks. Balchunas noted that this is a good sign.

ETF units can be created in-kind or in cash. In cash creation, authorized participants provide cash to the ETF issuer in exchange for new ETF units.

The Bloomberg ETF analyst noted that “Cash creates makes sense” in his opinion because broker-dealers “can’t deal in bitcoin so doing cash creates puts onus on issuers to transact in bitcoin and keeps broker-dealers from having to use unregistered subsidiaries or third party firms” to deal with BTC. He added that it’s “Less limitations for them overall.”

Balchunas continued: “Only 2-3 filers had planned cash creates, the rest wanted to do in-kind. So [they] may have to adjust or risk delay.” Emphasizing that this development “doesn’t change our 90% odds up or down” of spot bitcoin ETF approval, he said it is a “good sign” that the approval process is progressing and the SEC “has a path forward in the plumbing that they are comfortable with.”

Many people in the crypto space view the SEC’s advice as positive. Marshall Beard, Chief Strategy Officer at crypto exchange Gemini, commented:

This is real progress. The cash vs in-kind debate looks to be finding clarity. For reference as well, the Canadian spot ETFs have been using the cash create model for years now.

However, some argue that in-kind creates are much better than cash creates. Gabor Gurbacs, strategy advisor at Vaneck, stressed that the SEC’s cash creates advice is “a sign that regulators don’t/unwilling [to] understand and accept the best aspects of ETFs and bitcoin.” He emphasized: “In-kind creates are simply much more efficient. Anyone managing an ETF knows this.”

Balchunas further noted: “My point on cash creates was that I could see the SEC’s POV [point of view] for wanting it but from investor’s POV in-kind arguably better in terms of the spread and taxation.” He concluded that we could see some issuers pushing for the in-kind process, adding that they may even succeed in engagement with the SEC staff.

SEC Chairman Gary Gensler recently stated that the securities regulator is considering eight to 10 spot bitcoin ETF applications. A number of people expect the SEC to approve multiple spot bitcoin ETFs at once early next year.

What do you think about the SEC advising exchanges to use cash creates for spot bitcoin ETFs? Let us know in the comments section below.

Comments

Post a Comment