Robert Kiyosaki, the author of best selling book Rich Dad Poor Dad, has revealed why he keeps buying gold, silver, and bitcoin. “Our leaders want more war and poverty,” he stressed, noting that the three investment types provide “lifelong financial security and freedom.” He recently made several bullish predictions about the price of bitcoin, ranging from $135,000 to $1 million.

Robert Kiyosaki Shares Why He Keeps Investing in Bitcoin

The author of Rich Dad Poor Dad, Robert Kiyosaki, has disclosed the reason behind his ongoing investments in gold, silver, and bitcoin. Rich Dad Poor Dad is a 1997 book co-authored by Kiyosaki and Sharon Lechter. It has been on the New York Times Best Seller List for over six years. More than 32 million copies of the book have been sold in over 51 languages across more than 109 countries.

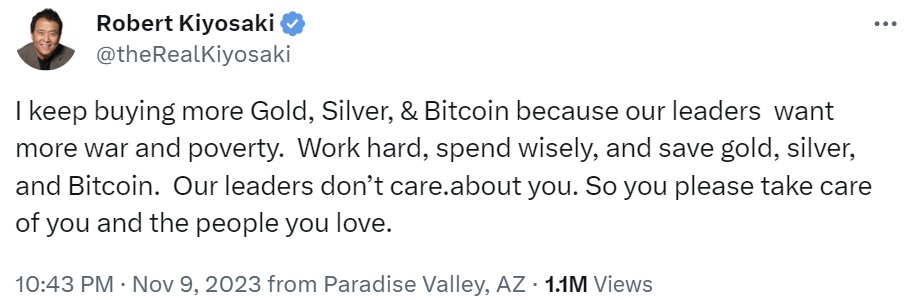

Kiyosaki shared on social media platform X Thursday that his consistent purchases of gold, silver, and bitcoin are driven by the belief that U.S. leaders want “more war and poverty.” He went on to advise people to preserve wealth in the three asset classes.

Kiyosaki has been recommending gold, silver, and bitcoin for quite some time. Earlier this month, he broke down Rich Dad’s lesson number one, stating that the three asset classes provide “lifelong financial security and freedom.” He also believes that they are the best investments for “unstable times.”

The famous author suggests allocating 75% of investment portfolios to gold, silver, and bitcoin, with the remaining 25% invested in real estate and oil stocks. “This mix may allow you to survive the greatest crash in world history,” he said. He also recommends using dollar cost averaging, noting that he is not trying to pick stocks like Warren Buffett.

Kiyosaki has made a number of bullish predictions about the price of BTC, ranging from $135,000 in the near term to $1 million in the event of a global economic crisis. He has also predicted that gold could reach $75,000 and silver could reach $60,000 in the same scenario. In February, he projected that the price of bitcoin would reach $500,000 by 2025, while gold could rise to $5,000 and silver could reach $500 within the same timeframe.

The renowned investor recently urged investors to buy bitcoin immediately, anticipating a rush to buy BTC as stock, bond, and real estate markets crash. He also expressed his belief in the future of cryptocurrency, calling fiat money “toast” and describing it as “fake money.” In addition to issuing multiple warnings about the greatest crash in real estate, stocks, and bonds, he also cautioned that the Federal Reserve raising interest rates would crash the U.S. dollar.

What do you think about Rich Dad Poor Dad author Robert Kiyosaki’s explanation of why he keeps buying gold, silver, and bitcoin? Let us know in the comments section below.

Comments

Post a Comment