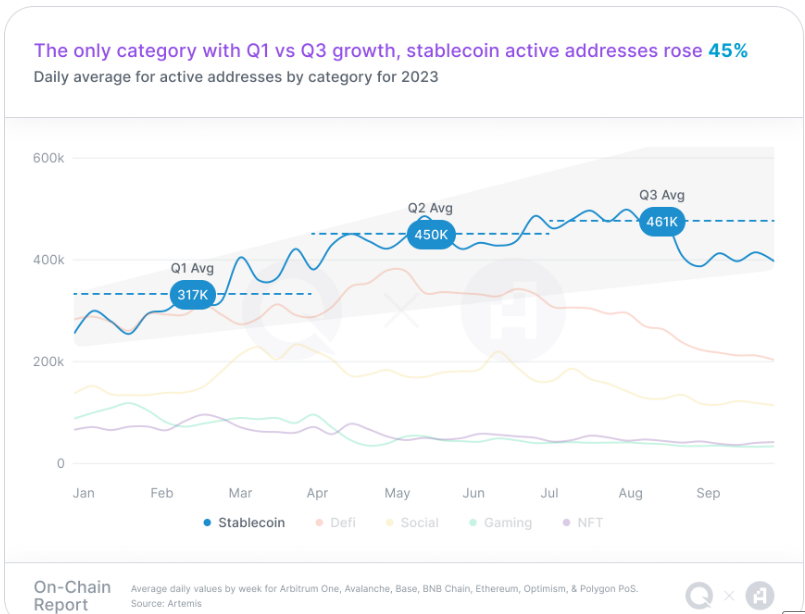

By the end of Q3 2023, activity in the stablecoin category as measured by the number of daily active addresses (DAA) stood at over 400,000 — the highest in any category. In the decentralized finance (defi) category — the next highest-ranked category — the number of DAAs at the end of Q3 was just over 200,000.

Stablecoin Activity Nearly Doubles That of Decentralized Finance

According to the findings of Quicknode’s latest study, stablecoins are now ranked the most popular blockchain category after ending Q3 with 400,000 daily active addresses (DAA). In addition, the stablecoin category is the only one to register growth in the three quarters that were reviewed. For instance, in Q1 the average DAAs stood at 317,000 and went up to 450,000 in Q2. In Q3, the category’s DAAs had increased marginally to 461,000.

As shown by the study data, the stablecoin category’s DAAs at the end of Q3 are approximately double that of the next highest-ranked category — decentralized finance (defi). In the past, defi had the most DAAs and at the start of Q1, and the category had slightly more activity. However, after rising to nearly 400,000 DAAs sometime in Q2, activity in the defi category gradually declined. By the end of Q3, there were just over 200,000 DAAs.

The study, which was prepared alongside the institutional data platform for digital assets Artemis, was primarily focused on seven notable chains, namely: Arbitrum One, Avalanche, Base, BNB Chain, Ethereum, OP Mainnet, and Polygon PoS.

Rise in Decentralized Social App Activity

Commenting on the study’s findings, Dmitry Shklovsky, the co-founder and CEO of Quicknode, an end-to-end development platform for Web3 innovation, said:

By centering the narrative around blockchain developers and end users, we gain valuable insights into the roadmap for building a sustainable and rapidly expanding Web3 ecosystem. These insights, combined with the context of product launches and investments, give us a comprehensive story of where we’re heading.

Meanwhile, in addition to highlighting the rise in stablecoin activity, the study findings also revealed decentralized social applications’ emergence as a new force and how the Friend.tech phenomenon has been central to this. The findings also indicate that development activity “remains strong only on Optimism’s OP Mainnet.” This, according to the study, suggests that “developers see EVM scaling solutions as a critical problem to solve in the near term.”

In terms of future trends, the investment data examined suggest that gaming and artificial intelligence offerings “are where the blockchain ecosystem will see the greatest emergence in the coming years.”

What are your thoughts on this story? Let us know what you think in the comments section below.

Comments

Post a Comment