On Dec. 18, 2023, a colossal cache of dormant bitcoins stirred after remaining inactive for eight years and ten months. The whale transferred 2,101 bitcoins, originating from 2015, now valued at $88.55 million, utilizing the prevailing BTC exchange rates.

$88M Worth of Bitcoin Moved by Long-Dormant Whale

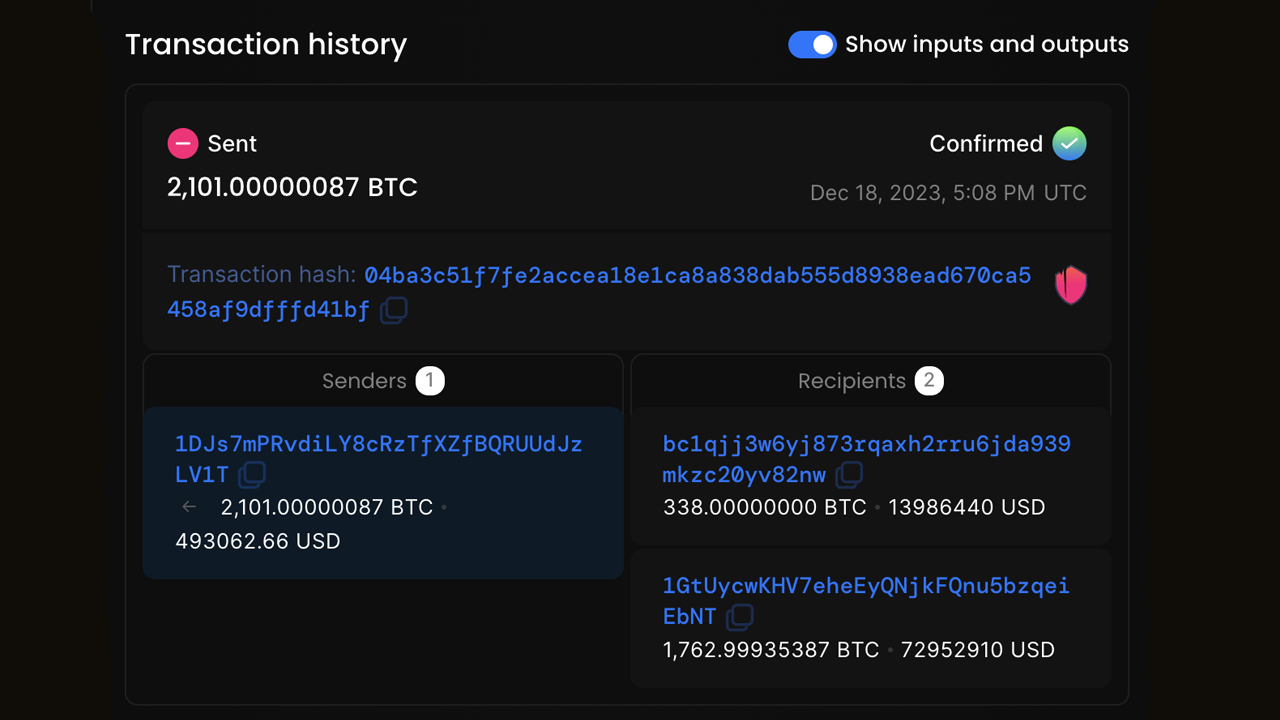

On Feb. 17, 2015, a substantial accumulation of dormant bitcoins was first recorded. This stash came to life after eight years and ten months on a Monday, with the whale from past years moving 2,101 BTC valued at $88.55 million at block height 821,802. The transfer originated from the BTC address “1DJs7,” a movement that was detected by btcparser.com.

Back in 2015, when 1DJs7 initially received the 2,101 BTC from “1CJee,” the total value stood at $510,543, with each bitcoin priced at $243. The wallet 1CJee had acquired these bitcoins a year earlier, on August 7, 2014, sourcing them from two separate addresses.

Fast-forward to the present, this long-inactive P2PKH address distributed the bitcoins to two new addresses. Around 1,762.99 BTC was sent to another P2PKH address (1GtUy), and 338 BTC was transferred to a Bech32 (bc1qj) address, which uses the Segwit address format. As of this writing, the combined $88 million in bitcoin at these addresses remains untouched. The whale spent around $26.77 or 290 satoshis per virtual byte to send the $88 million.

The whale displayed little concern for privacy, as evidenced by Blockchair’s privacy tool, which rated the transaction a mere 0 out of 100, citing matched address identification and other security lapses. Though not as vintage as 2011 or 2010 coins, the 2,101 ‘sleeping BTC’ represented a significant cache.

Furthermore, on Dec. 15, 2023, four seven-year-old addresses (1, 2, 3, 4) from October and December 2016 became active, totaling a transfer of 734.98 BTC. This activity, worth $30.93 million, likely originated from the same entity, with the initial two transactions confirmed at block height 821,361 and the latter two at 821,367, occurring simultaneously.

It remains uncertain whether the whales from 2015 and 2016 have sold their holdings or merely shifted them for enhanced security or address updates. Such movements by whales are often shrouded in mystery, leaving the community speculating. However, a notable trend is emerging: numerous so-called ‘sleeping bitcoins’ are reawakening, stirring curiosity and speculation in the crypto world.

What do you think about the 2015 whale that moved 2,101 BTC after sitting idle for so long? Share your thoughts and opinions about this subject in the comments section below.

Comments

Post a Comment