Powell’s Fed Policy Criticized: Experts Claim ‘Phony Economy’ and ‘Credibility Destruction’ Post Rate Decision

The Federal Reserve’s most recent session of the Federal Open Market Committee (FOMC) wrapped up, leaving interest rates as they were. The market, expecting rate reductions in 2024 and influenced by Fed Chair Jerome Powell’s dovish stance, reacted positively. This uplift was evident in the rise of U.S. stocks, the crypto economy, and precious metals like gold and silver.

Federal Reserve Maintains Current Rates, Eyes Potential Reductions in 2024

Following the FOMC’s latest announcement, financial benchmarks displayed a bullish trend. Major U.S. stock indices saw substantial growth, mirroring the market’s upbeat mood post-meeting. The crypto sector also rallied, recording a significant 3.66% increase, with bitcoin (BTC) ascending 4%. Moreover, traditional safe-haven assets like gold and silver rose by 2.41% and 4.48%, respectively, reflecting a widespread optimistic response to the Fed’s decision.

In his comments after the meeting, Powell discussed the present economic situation. He stated the economy isn’t currently in a recession, but didn’t dismiss the potential of one next year. Powell underlined the need for careful monetary policy, saying, “We are very focused on not making the mistake of keeping rates too high too long.” He further acknowledged the progress on core inflation and non-housing services inflation. His comments suggested a cautious yet adaptive approach to future monetary policy adjustments.

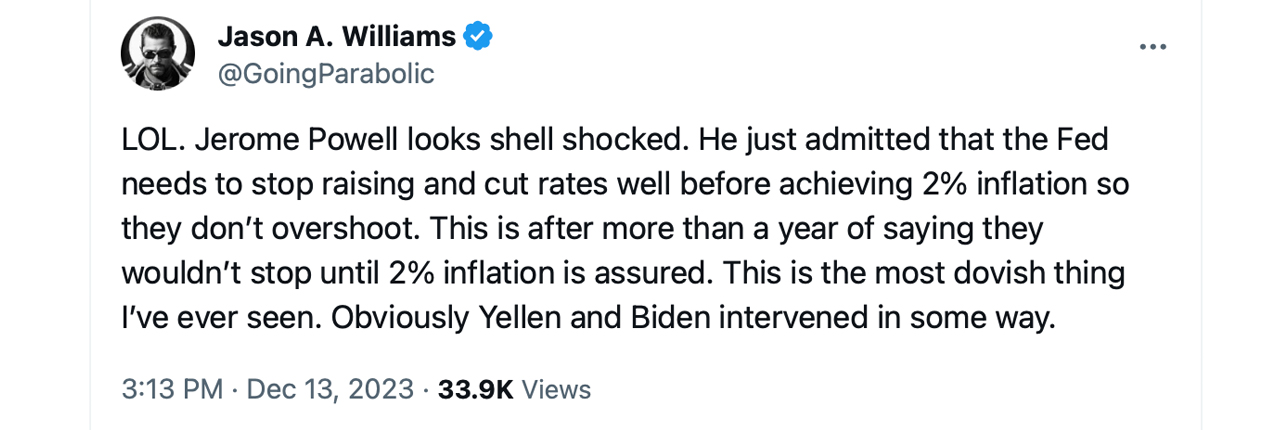

Contrary to some market speculations, further rate hikes seem unlikely. Powell indicated a shift in the central bank’s policy, hinting that the current policy rate is likely at or near its peak for this tightening cycle. This is significant as it aligns with the speculators’ belief that the Fed may be done hiking rates and that cuts could be on the horizon in 2024. The FOMC’s statement and Powell’s remarks, highlighted the Fed’s commitment to returning inflation to its 2% target, but the method to achieve this appears to be evolving.

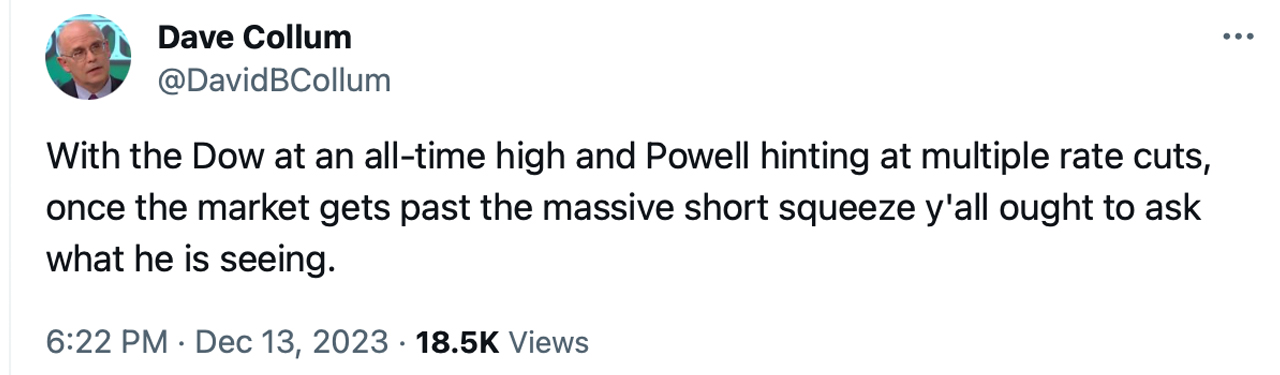

Several market experts weighed in post-Powell’s speech. Economist Peter Schiff commented on social media platform X, “The only reason Powell can claim he won the inflation war without inflicting any collateral damage on the economy or employment is because he didn’t actually win, he surrendered,” Schiff added. “The only reason the phony economy and bull market are still alive is that inflation is not dead.”

Sven Henrich of Northman Trader offered his insights. “By further fanning the fire of easing financial conditions Powell has abandoned all his previous tough talk which the market had already ignored anyways,” Henrich wrote. “The credibility destruction is now complete.” Henrich added:

Powell claims the Fed is at a restrictive policy level while financial conditions have eased to the same loose levels they were when they started raising rates.

The X account known as “QE Infinity” posted, “Powell just poured a giant can of lighter fluid on a fire that was about to [burn out]. Consequences be damned.” The FOMC’s choice to maintain the federal funds rate was influenced by various factors, including persistent inflation worries and the broader economic climate.

However, while Powell’s address indicated that rate hikes are nearing their limit and reductions might occur in 2024, the CME Fedwatch tool predicts a rate increase at the next FOMC meeting in January. The market anticipates a hike with a probability of 89.7%, while 10.3% foresee no change.

What do you think about the Fed’s stance right now? Do you expect more hikes or rate cuts in the future? Share your thoughts and opinions about this subject in the comments section below.

Comments

Post a Comment