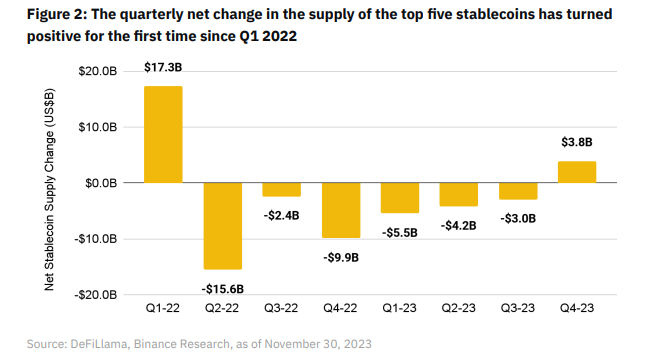

During Q4 of 2023, the stablecoin supply available to invest in crypto assets was $3.8 billion. This is the first time the net supply of the top five stablecoins has turned positive in nearly two years. In 2023, zero-knowledge (ZK) technology became one of the most consistent talking points in the crypto space.

Stablecoin Inflows Outpacing Outflows

After six consecutive quarters of negative net supply, the top five stablecoins recorded a positive net supply of $3.8 billion in Q4, according to a new study by Binance. The last time the stablecoin supply was positive was in Q1 2022 when it exceeded $17 billion. As explained in the study report, stablecoin supply indicates the amount of capital that is ready and available to buy crypto assets.

The study data shows that Q2 2022 had the largest negative net supply of $15.6 billion, while Q3 of the same year had the lowest negative net supply during the period. However, since the last quarter of 2022 when it topped $9.9 billion, the stablecoin inflows have outpaced outflows.

“Given that increasing stablecoin supply is a measure of capital inflows into crypto and

an indication of potential buying pressure, the recent move can be evaluated as a positive sign,” the study said.

The Rising Protocol Fees

According to the study, the other key narrative in 2023 and one to look out for in the coming year is the rise in protocol fees in November. As shown by the data, protocol fees of the top 20 projects were “over 88% higher on a month-on-month basis in November as compared to January.”

The Ethereum blockchain generated over $2 billion in fees, followed by Tron with $880 million. Decentralized platforms Lido Finance and Uniswap had the next highest generated fees, with $547 million and $477 million, respectively.

In 2023, zero-knowledge (ZK) technology also became one of the most consistent talking points in the crypto space. Previously, the growth of ZK technology was constrained by its incompatibility with the Ethereum Virtual Machine (EVM). However, the introduction of special types of ZK-rollups known as zkEVMs meant that smart contracts could now be easily deployed on the EVM. In 2023, several such special types of ZK-rollups were launched.

The other top ten narratives in 2023 as per the Binance report include the emergence of real-world assets (RWA) and Socialfi. The growth of alternative layer ones (L1), the re-emergence of decentralized finance (defi), and talk of a decline in interest rates were also among the key narratives of the year.

What are your thoughts on this story? Let us know what you think in the comments section below.

Comments

Post a Comment